Offering and Experience Maps | Transform the lending experience

Problem: How can our Target State Experiences outlined for 2024+ be achieved when our current state lending experiences are so far from delivering any of those experiences.

Approach:

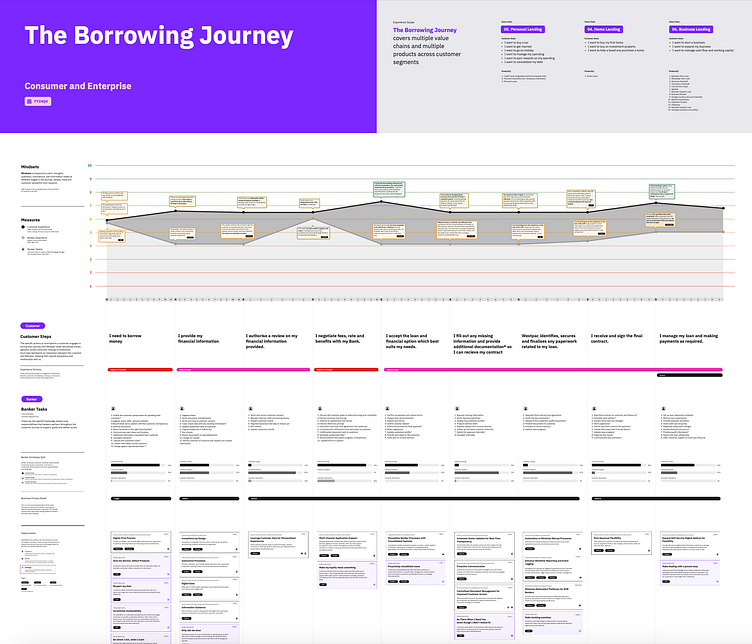

In this project, I led the end-to-end design process for the modernization of the lending, focusing on both consumer and business lending [excluding Institutional banking]. The approach centered on creating a holistic customer and banker experience by validating current processes, identifying key opportunities, and designing future state solutions aligned with strategic business goals aligned to the core value proposition of the bank.

Outputs:

Product Business Requirements

Digital & Printed Agnostic Lending Experience Maps (Current & Future State)

Key Data and Outcomes

Concept Cards & Prototypes for Testing

Prioritized Concept Spreadsheets for Implementation

Impact:

Increased Collaboration:

By engaging cross-functional teams (product, channel, compliance, technology), the process fostered a more collaborative environment. This allowed for a shared understanding of the goals and alignment on the priorities for lending modernization.

Streamlined Lending Journey:

The future state map aligned with the bank's Customer Value Proposition (CVP), improving the efficiency of lending operations and creating a seamless experience for both consumer and business lending processes. This modernization of tools and processes allowed bankers to work more effectively and deliver improved customer experiences.

Clear Roadmap for Modernization:

The prioritization of solutions and clear next steps, such as concept testing and future playback sessions, set the foundation for continuous improvement. The phased approach ensured that each stage built on validated findings, reducing risks and enhancing the likelihood of successful implementation.

The future state map [not displayed here due to confidentiality] illustrate how lending applications can flow seamlessly from initial login to loan approval, including pre-populated customer information, aligned workflows, and transparent tracking. The offering cards define each stage's purpose and the responsibilities of compliance, business value, and strategic uplift.

These elements ensure that bankers can guide customers through each step efficiently, while also meeting regulatory requirements.