Card Sorting | Validated Banker Personas

Problem: Bankers faced challenges in organizing customer profile information, leading to inconsistencies and inefficiencies in managing client relationships.

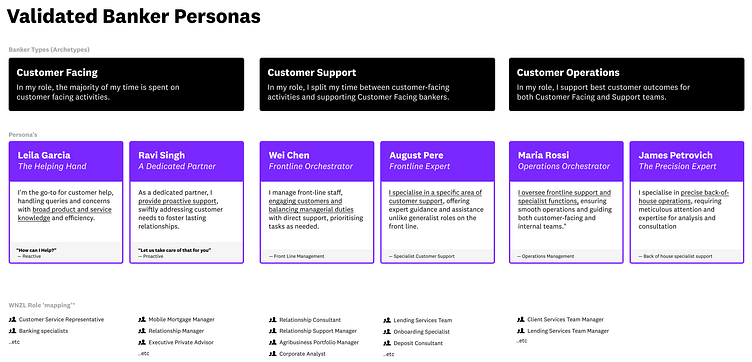

Hypothesis: Concentrating on similarities among banker roles (customer-facing, support, and operations) allows for the standardization of customer information, ensuring service consistency.

Approach: Conducted in-depth interviews with 12 banker participants to empathize with their responsibilities and challenges. Identified patterns in how bankers think about and group information related to customer profiles.

Research Method: Moderated open card sorting sessions, where bankers were presented with cards representing information focused on a customer’s profile in the current D365 environment. Participants organized and grouped these cards based on their understanding and preferences.

Educating the wider business and stakeholders with the Pack:

What is a Persona in Our Context? Banker personas represent employee types relative to how they support customers. They help us understand and empathize with their responsibilities and challenges.

What is Card Sorting? Card sorting is a research technique where participants organize labeled cards into groups based on their thinking. In our study, we applied this method to gain insights into bankers' attitudes, values, preferences, and behaviors, shedding light on their decision-making processes and organizational dynamics.

How Did We Create Our Cards? For each card presented to our bankers, we asked them to:

Provide a brief understanding of each card (e.g., what information they would expect to see under "Customer Details").

Place the cards into groups of information that made the most sense to them.

Answer tailored questions to understand their logic and information based on various role types, naming the groups based on the categories they formed.

Solution: Developed validated banker personas that reflect the diverse roles and perspectives of bankers, informing future design decisions.

Impact: Provided actionable insights that guided the redesign of customer profiles, ensuring they align with banker needs and enhance usability.

(Appendix available upon request, detailing research methodology and insights.)