Merchant | End-to-end process documentation for onboarding

Problem: Inefficiencies in the merchant onboarding process hinder timely and accurate integration into the banking platform, impacting conversion rates and overall customer experience.

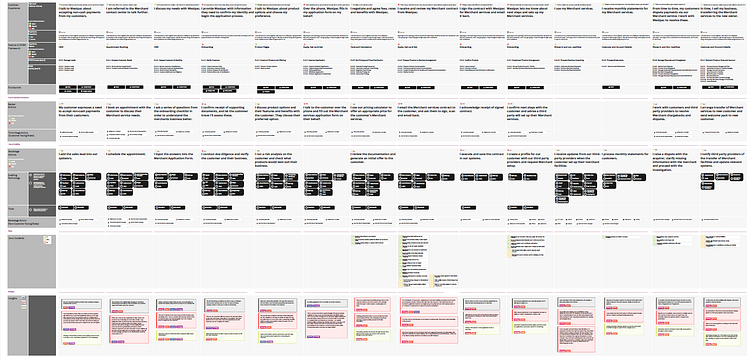

Approach: Documented the end-to-end process collaboratively with frontline teams over 6 months of Discovery, focusing on tasks involved in onboarding a new merchant.

Solution: Delivered two key outcomes:

Interim Experience Map: Highlighted small victories achievable with minimal investment to improve the onboarding process.

Future Experience Map: Outlined substantial investments needed to enhance systems and tools for both bankers and customers, aiming for an optimal market experience.

Key Findings:

Extensive human intervention in pricing calculations, AML verification, and risk assessment leads to errors and delays.

Gaps such as insufficient follow-ups and manual verifications may decrease conversion rates and prolong onboarding times.

Additional issues, including manual price calculations and reliance solely on phone processes, can result in inaccuracies and poor customer experiences.

This analysis has pinpointed critical areas for improvement, paving the way for detailed design enhancements.

(High-level service blueprint providing customer and banker metrics is available in my portfolio.)