Advance VAT Return - Step 3

At the end of last year, we shipped the first iteration of the FastBill advance VAT return process. The overall process in split-up in small and easy to process junks, so the user doesn't get overwhelmed with too bureaucratic and complex input fields.

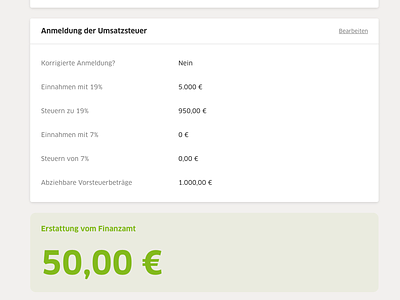

This is the third and last step of the form wizards. It gives the user a chance to review all the entered data before submitting it to the German tax authorities. The action is essential to provide the user with the safety and confidence that the information is correct and the potential for errors is at a minimum.

It also gives the user a rough estimate on how much money they have to transfer to the German tax authorities, or maybe get back.

More by Jan Früchtl View profile

Like