Zelle Pay

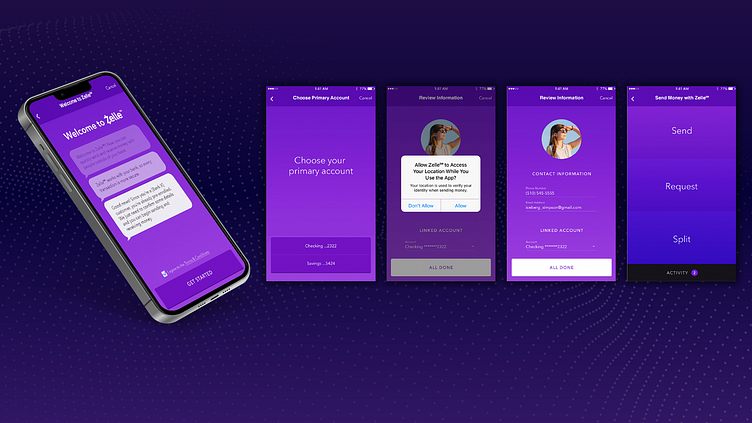

The Zelle app required a user to enroll to send and receive money upon first time use. This shows organic enrollment, which was a different entry point than enrolling via receiving a payment.

Overcoming Early Challenges

Zelle began as a struggling incubated project within a payment processor business, with the goal of creating a peer-to-peer payment network to meet the growing demand for mobile payment apps. Despite early challenges, Zelle was transformed into a groundbreaking product that achieved widespread adoption and user engagement. Our objective as the product and design team was to develop and launch a scalable, user-friendly peer-to-peer payment solution—an achievement that ultimately redefined mobile payment solutions within the banking industry.

The initial phase of Zelle’s development was hampered by dependencies on inefficient third-party consultants and agencies, which made it difficult to create a stable and scalable Minimum Viable Product (MVP). To course-correct, Early Warning, Zelle’s parent company, recruited new product and design leadership to build in-house expertise and redefine the project’s direction.

We tackled previous failures by emphasizing customer-centric design, product-led growth, and cross-functional collaboration across IT, product, marketing, and design teams. Achieving a “zero to one” transformation required building a new team capable of rethinking the product from the ground up. This effort involved months of intensive kanban and agile delivery sprints, culminating in a launch-ready MVP.

Designing and Optimizing the MVP

The early days following the MVP launch were marked by rigorous quality assurance (QA), user acceptance testing (UAT), and continuous optimization. We conducted targeted sprints to improve the user experience, focusing on specific personas and their "Jobs to Be Done." Pain points were systematically addressed to reduce friction, streamline workflows, and refine the interface.

Recognizing the critical importance of security, our business line president established a dedicated "war room" to monitor and address fraud in real time. This proactive approach generated a backlog of issues and opportunities that were swiftly prioritized and resolved through design and feature updates. Simultaneously, we created an innovation incubator team to explore and thread new features—and even entirely new product concepts—into the roadmap.

Enroll to Receive

An unregistered user receives a notification to receive money or respond to a request. This notification can be an email as shown or a text message from their network bank. Completing a transaction registers the recipient via their network bank.

Request Payment

The request functionality allows a user to send a request for payment to one recipient at a time. The app uses local contact list, members of participating banks are registered to the network using their phone number.

Send Payment

We devised a design pattern for transactions that begins with selecting a recipient or someone to request payment from, entering your amount, reviewing / sending and then confirmation.

Split Requests

Users are able to split a payment and request money from multiple people and keep an open record of who has paid and who hasn’t.

Defining the P2P Payment Industry

During my time as Head of Product Design, we built a team, process and product that defined P2P payments in the banking industry:

Our iOS & Android apps received a WCAG AAA Accessibility Rating and achieved 4.5 stars in the respective app stores supporting over 4M members within 4 months of launching.

The Zelle network usage achieved in excess of 80M members processing 170M transactions and $75B in P2P payments in year 1.

We integrated Zelle into every major banking app, seeing an average of 100,000+ new registrations daily.