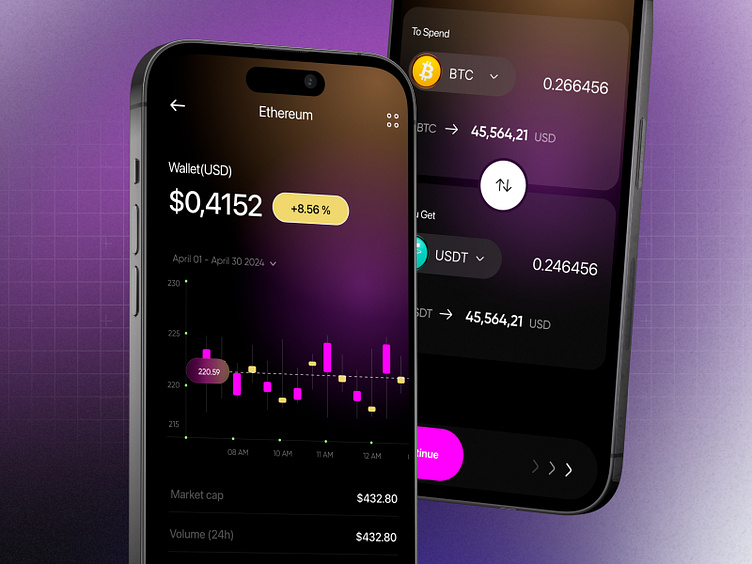

Finance Application mobile ui design

Hey Everyone! 👋

Super excited to showcase my latest design concept: a Finance Application Mobile UI Design! 💳📱 This project is all about empowering users to manage their finances with clarity and ease.

From budgeting tools to transaction tracking, I’ve focused on crafting a user-friendly, secure, and visually appealing experience. 🌟

💬 Let’s discuss!

I’m online in Telegram and Discord to discuss your project:

Telegram: http://t.me/doctordesign

Discord: https://discordapp.com/users/r.koohi99#8459

LinkedIn: www.linkedin.com/in/rooholla

Email: R.koohi99@gmail.com

Some of my other works✨

💬 Let’s discuss!

I’m online in Telegram and Discord to discuss your project:

Telegram: http://t.me/doctordesign

Discord: https://discordapp.com/users/r.koohi99#8459

LinkedIn: www.linkedin.com/in/rooholla

Email: R.koohi99@gmail.com

Designing a finance application mobile requires a highly functional UI/UX design that ensures security, simplicity, and an intuitive experience while managing personal finances. Whether it’s a budgeting app, investment platform, or a mobile banking app, the primary goal is to create a streamlined, user-friendly interface that makes financial management accessible to everyone. The landing page of a finance mobile app should immediately provide value, with a hero section that displays the key features of the app, such as expense tracking, investment tools, real-time updates, or personal finance management. This section should include clear CTAs like “Get Started” or “Track Your Spending,” encouraging users to dive deeper into the app.

The navigation bar should feature a minimal and intuitive layout, giving users quick access to essential sections such as dashboard, transactions, reports, investments, and settings. The dashboard is the heart of a finance app, where users can view an overview of their financial status, including account balances, recent transactions, budget tracking, and spending categories. For a more personalized experience, AI-powered features can offer tailored spending insights, helping users track how they are spending money and where they could potentially save more.

A spending tracker within the finance app should categorize transactions, showing users where their money is going each month. It can display breakdowns by categories like groceries, entertainment, subscriptions, and utilities. The app should be able to generate reports on spending trends, helping users set financial goals. Integration with banking APIs to automatically pull transaction data, along with the option for manual entry, creates a seamless tracking experience.

A crucial feature of any finance application is payment management. The app should support a variety of payment options, such as credit cards, debit cards, and digital wallets (e.g., Google Pay, Apple Pay), allowing users to link and manage their payment methods easily. Recurring payments like subscriptions or loan payments should be tracked, ensuring that users never miss a due date. For a mobile banking app, direct bill payments and the ability to transfer funds between accounts is a must-have feature, along with security encryption to ensure all transactions are safe.

An investment module could allow users to manage their stocks, mutual funds, or cryptocurrency investments, directly from the app. This section should have real-time market data, showing stock prices, investment performance, and news relevant to the financial world. For a more advanced experience, users can get access to technical analysis tools, price alerts, and even AI-driven investment advice. Integrating a cryptocurrency tracker would let users monitor digital asset prices, access crypto wallets, and easily trade coins like Bitcoin, Ethereum, and others.

To enhance the user experience, the app should provide budgeting tools that allow users to set spending limits for specific categories. For instance, if a user sets a budget for groceries, the app should automatically warn the user when they are nearing their spending limit, providing notifications for overspending. Offering features like automatic categorization and receipt scanning can simplify the process, allowing users to capture expenses on the go.

The transaction history is a fundamental section in any finance app, where users can view past purchases, bill payments, and account activity. The ability to search through transaction history by date, amount, or category helps users quickly find any specific transaction. Filtering by merchant or payment method can further enhance the transaction search experience.

For a mobile banking app, seamless integration with traditional banking services like checking accounts, savings accounts, and credit cards is crucial. Users should be able to access real-time balance information, view detailed transaction history, and transfer money between their own accounts or to other users, all within the same app. Push notifications can alert users about large transactions, pending bills, or low balances, ensuring that they are always up-to-date with their finances.

The security features of a finance mobile app are paramount. It’s essential to implement multi-factor authentication (MFA), biometric login (fingerprint or face recognition), and end-to-end encryption to protect sensitive data. A secure payment gateway is vital for any payment-related transactions within the app, ensuring that personal and financial data remains safe. Additionally, users should be able to easily lock their accounts, freeze cards, or disable payments if they suspect any fraudulent activity.

A credit score tracker could also be a valuable feature, offering users insights into their credit score and providing tips on how to improve it. Integrating features like credit card management, loan calculators, and offering personalized recommendations based on credit scores can make the app an essential tool for users who want to manage and improve their financial health.

To keep users engaged and motivated to use the app regularly, integrating gamification elements like reward points or financial milestones can be effective. For example, users could earn points for sticking to their budget, making timely payments, or reaching savings goals, which could be redeemed for discounts or other rewards. This adds a layer of motivation, making finance management feel more interactive and fun.

A multilingual interface is essential if the app is targeting a global audience. Supporting multiple languages and local currencies ensures that users from various regions can use the app in their preferred language and financial system. This is especially important if the app has an international payment system or users are dealing with foreign investments.

Integrating AI into the app can provide personalized financial advice based on users' spending habits, goals, and income levels. Chatbots or virtual assistants can help answer financial queries or guide users through complex features, like investment strategies or loan applications. Additionally, using machine learning to identify fraudulent activity or unusual transactions can greatly enhance the app's security.

For seamless interaction, the app interface should be designed with a clean, minimalistic layout, focusing on clarity. The typography should be legible, and the color palette should be calming, with contrasting buttons for actions like Make Payment or View Reports. A responsive design ensures that the app functions smoothly across different screen sizes and devices, whether it’s an iPhone or an Android phone.

Finally, analytics integrated into the app can track user behavior, such as the most used features or the types of transactions being made. This data can help developers optimize the app, improving features like the budgeting tools, investment options, or payment methods, making the app even more tailored to the needs of its users.

In conclusion, designing a finance mobile app is all about combining secure features, intuitive UI/UX, and personalized financial tools to help users manage their finances with ease. Whether it’s for budgeting, investing, saving, or tracking spending, a well-designed finance app should empower users to take control of their financial future, all within a safe, efficient, and interactive mobile experience.

💬 Let’s discuss!

I’m online in Telegram and Discord to discuss your project:

Telegram: http://t.me/doctordesign

Discord: https://discordapp.com/users/r.koohi99#8459

LinkedIn: www.linkedin.com/in/rooholla

Email: Hi@roohi.pro