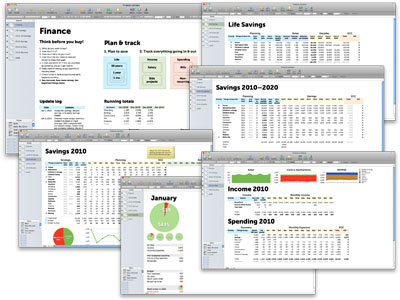

Finance

Finance sheet is for high-level planning. I use it for tracking changes, reminding myself how to save and spend, and an overview of my funds.

Life Savings sheet is for planning to save for big things like retirement, kids, college, cars, and computers. That sheet is broken into decades, i.e. How much do I need in 2050? How can I ramp up my savings to reach that goal?

From the Life Savings sheet, I have a decade savings plan, i.e. How will I save $50,000 from now until 2020 for Retirement?

Savings 2010 is a sheet to plan/track goals derived from the 2010–2020 sheet (which pulls data from the Life Savings sheet above it).

Income 2010 / Spending 2010 sheet is for the setting up the month to month budget.

The sheet titled January is where I track my monthly and weekly spending. The big pie chart shows my overall status for that month, and the tiny pies are for each week in the month.

All these sheets pull data from the one above it and below it so I can get real-time feedback when I update a goal (in the Decade sheet) or save more than I thought I could (in the Income/Spendings sheet).

This took about 4 (vacation) days to set up and get rocking.