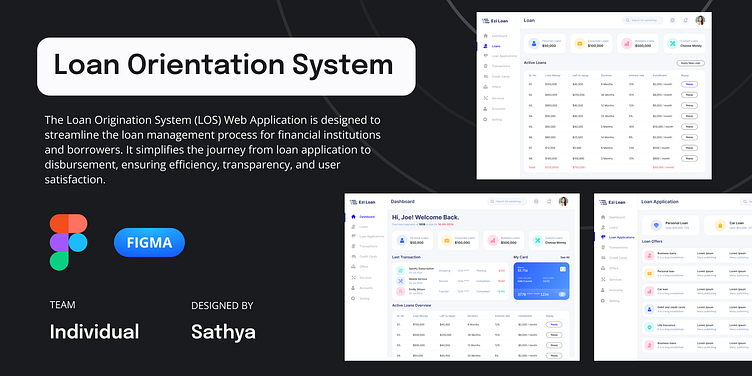

Loan Origination System (LOS) Web Application

Overview

The Loan Origination System (LOS) Web Application is designed to streamline the loan management process for financial institutions and borrowers. It simplifies the journey from loan application to disbursement, ensuring efficiency, transparency, and user satisfaction.

Why Users Need This Application

Streamlined Loan Processing: Lenders can manage multiple loan applications efficiently, while borrowers experience a seamless application and tracking process.

Transparency: Borrowers have real-time access to loan statuses, reducing uncertainty and improving trust.

Compliance and Documentation: The app ensures that all necessary documents are uploaded and validated, reducing compliance risks for lenders.

Automation and Efficiency: Automated workflows reduce manual intervention, speeding up the approval process and minimizing errors.

Why Users Need This Application

Streamlined Loan Processing: Lenders can manage multiple loan applications efficiently, while borrowers experience a seamless application and tracking process.

Transparency: Borrowers have real-time access to loan statuses, reducing uncertainty and improving trust.

Compliance and Documentation: The app ensures that all necessary documents are uploaded and validated, reducing compliance risks for lenders.

Automation and Efficiency: Automated workflows reduce manual intervention, speeding up the approval process and minimizing errors.

Future Implementations

Loan Application Builder:

A customizable form for borrowers to input details, upload documents, and calculate eligibility.

Automated Notifications:

Email or SMS alerts for application updates, payment reminders, and document requirements.

Credit Score Integration:

Integrate with credit bureaus to automate credit score checks during the application review process.

Document Management System:

Secure upload, storage, and verification of documents with version tracking.

Analytics and Reporting:

Advanced insights for lenders, such as loan performance metrics, risk analysis, and borrower trends.

Role-Based Access Control:

Permissions and access levels based on user roles (e.g., admin, loan officer, borrower).

Multi-Language and Multi-Currency Support:

Adaptability for global use.

Integrated Payment Gateways:

For seamless EMI collection and payment processing.

Conclusion

The Loan Origination System Web Application focuses on improving efficiency and user experience in loan management. With core sections like the dashboard, active loans, loan applications, and loan details already in place, it provides a strong foundation for managing loans effectively. Future enhancements will ensure it evolves into a robust, all-encompassing tool for financial institutions.

Follow for more :

Dribble : https://dribbble.com/Joe_jo

Behance : https://www.behance.net/joejo9

LinkedIn : https://www.linkedin.com/in/sathya-a-b5048092/

Instagram : https://www.instagram.com/_bbn_joe/