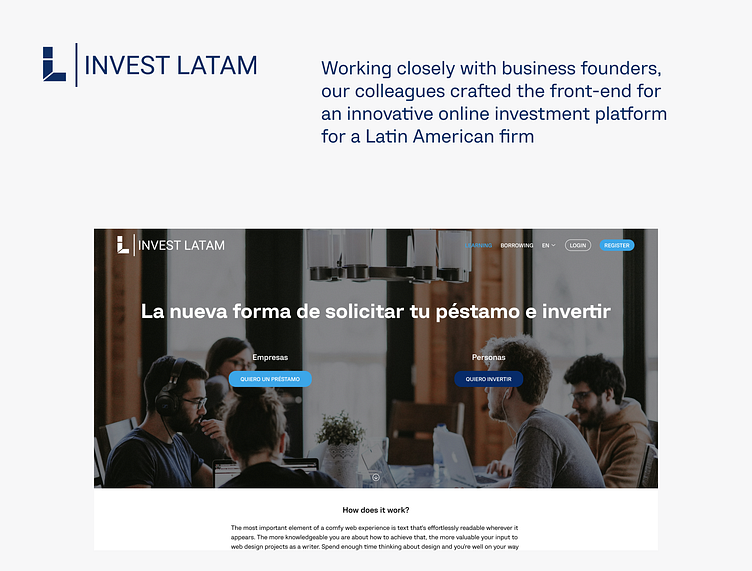

Invest Latam

AT A GLANCE

A finance-focused medium business in Latin America needed an efficient platform to connect small businesses with investors for direct loan transactions. Our team developed a platform enabling companies to receive online loans from investors while allowing investors to invest funds and earn returns. Computools assisted in streamlining the process, ensuring reliable KYC, verification, and integration with financial services, significantly enhancing the client’s business operations and customer satisfaction.

THE CLIENT

The platform facilitates the connection between investors and businesses or individuals in Latin America, enabling them to negotiate and finalise loan agreements directly. With a minimum savings threshold of COP $500,000, individuals can join the platform and choose the interest rate they want to invest.Companies and individuals engaging with the service undergo a formal credit evaluation process, providing necessary guarantees, and are subject to monitoring by a debt recovery firm in the event of payment delays. This stringent process ensures safety and reliability in the loan transactions conducted through the platform.Recent successes include facilitating over 1,000 business transactions in the past five years and establishing a solid operational presence across South America. With a rigorous credit evaluation process and monitoring by a debt recovery firm, Invest Latam ensures safety and reliability in all loan transactions, providing a trustworthy environment for both investors and businesses.

USER PERSONA & SITE MAP

BUSINESS CHALLENGE

Small businesses in Latin America struggled to secure loans through traditional banking channels, encountering lengthy processes, stringent criteria, and limited access to funding. This created a substantial barrier to growth and development for these businesses. At the same time, investors were seeking alternative opportunities for direct investment that offered meaningful returns.Invest Latam recognised the untapped potential in addressing these issues and sought to build a first-of-its-kind platform to match lenders and businesses in Latin America. The primary objectives were to ensure reliable KYC, verification, and creditworthiness check processes and to link to integrated payment mechanisms via a secure interface. By developing this platform, Invest Latam aimed to create a more efficient, accessible, and inclusive financial ecosystem.

SOLUTION SUMMARY

Our team broke down the platform’s concept into detailed user journeys and design prototypes. These prototypes focused on providing a quick visual summary for lenders and businesses, enhancing the user experience. The platform was developed according to a comprehensive implementation plan. We conducted A/B testing of several design decisions to ensure the most effective and user-friendly interface.The platform integrates seamlessly with financial services interfaces, ensuring reliable Know Your Customer (KYC) processes, verification, and creditworthiness checks. Additionally, we linked the platform to secure payment mechanisms, providing a smooth and secure transaction experience.Computools’ platform and product engineering expertise was pivotal in transforming the client’s vision into a functional and user-friendly platform. Our team created intuitive and visually appealing designs that simplify the process for both lenders and businesses. We ensured the platform’s reliability and security by integrating essential financial services and conducting thorough testing.

CONTACT US

Get in touch to discuss your project or service expectations.