Toomoro - Financial Management Dashboard

Overview

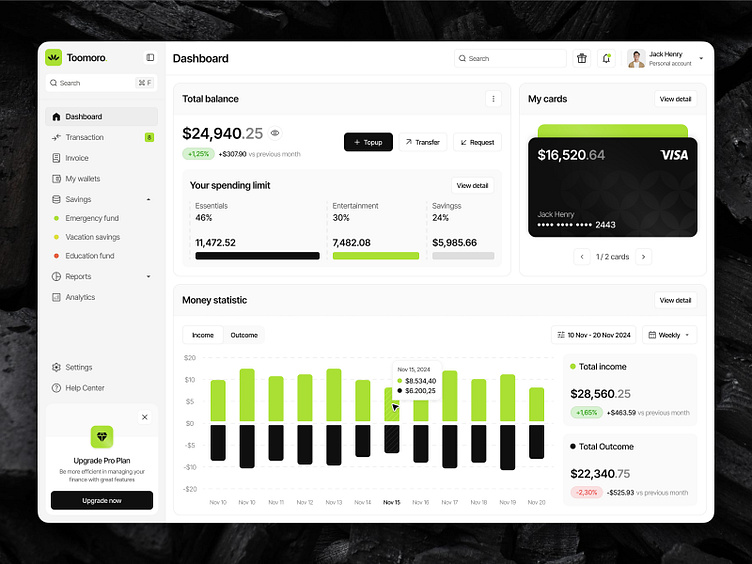

Toomoro is a comprehensive finance management platform designed to streamline budgeting, expense tracking, and financial planning. With an intuitive interface, Toomoro empowers users to manage their finances effectively, offering insights into spending patterns, savings, and goals. The dashboard layout combines ease of access with visually appealing data displays, providing users with a clear snapshot of their financial health at a glance.

Objective

Toomoro aims to address these issues by offering a user-friendly finance management interface with robust features for tracking income, expenses, and savings. With categorized spending limits, weekly and monthly statistics, and a clear display of total balance and spending trends, Toomoro ensures users can monitor their financial goals. The platform's flexible budget controls and expense categorization empower users to stay within their financial targets while optimizing their savings.

Problems

1. Difficulty in tracking expenses across different categories, leading to overspending or budget mismanagement.

2. Lack of centralized financial data, making it hard to monitor overall financial health.

3. Limited access to features that provide real-time insights, such as spending trends and category-specific limits.

4. Absence of flexible tools for setting savings goals and tracking progress.

5. Inability to compare income versus expenses visually, making financial forecasting challenging.

Solutions

1. Total Balance Module: Provides real-time insights into the user’s financial standing, including overall balance updates.

2. Spending Limit Trackers: Allows users to set and monitor spending categories such as essentials, entertainment, and savings.

3. Money Statistic Section: Displays weekly income and expense trends to help users identify and understand their spending patterns.

4. Card Management Feature: Centralizes information on available credit and debit cards, helping users keep track of card balances and transactions.

5. Fund Allocation Tools: Includes options for setting aside money for specific goals like an emergency fund, vacation savings, or education, promoting disciplined savings habits.

6. Income vs. Outcome Visualization: Provides a graphical representation of income and expenses, aiding users in financial forecasting and decision-making.

Wireframe

Mockup

Let's collaborate with us

🛍️ Download our Premium UI Kit on

Follow our pages and join the journey

Instagram | LinkedIn | Behance