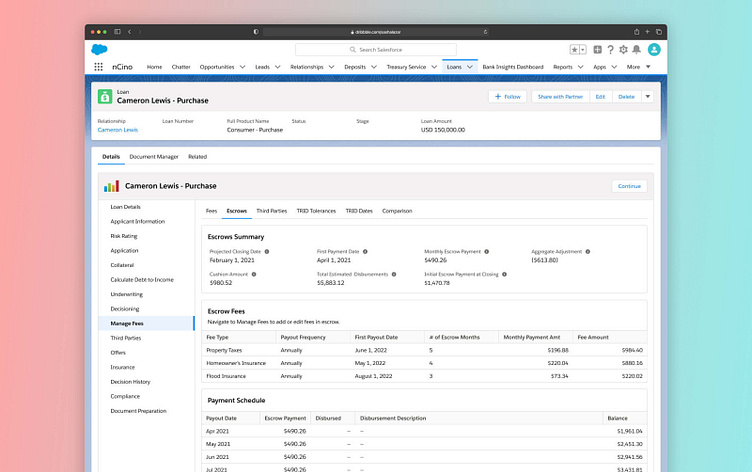

nCino Banking UX: Escrows Payment Schedule

Despite how amazing owning a home is, the process of buying one is a complete pain in the ass! Securing a loan is only part of it. Countless fees, regulations, and payment expectations can quickly overwhelm buyers, while the responsibility of properly curating and disclosing this information to those buyers can do the same to bankers. It's a sophisticated process with lots of margin for error.

Since nCino lacked the functionality to process home loans, their clients were forced to rely on outside solutions when customers needed them. nCino needed a powerful solution that enabled their software to process this information. Nailing this would save bankers, buyers, and nCino itself a lot of time and money.

What did I do?

My solution for Escrows Payment Schedule marked a major step forward for nCino's home lending efforts. This solution enabled bankers to determine specific escrow payment expectations within the app. These details are typically locked behind paywalls and require communication with outside entities. Now, bankers can use loan and fee details to calculate how much customers will need to pay (as well as when they will need to pay it) in real time.

What was accomplished?

✅ The Escrows Payment Schedule gave nCino a lot of momentum for future teams to continue to push into home lending, being adopted in US, CA, UK, and APAC.

✅ Calculating escrow payment schedules natively saved bankers up to a week every time a new calculation was needed (not to mention what it costs the bank to get this information from government entities).

✅ The customer experience was improved by cutting down time spent waiting for updates from bankers. Slimming down margins of error helps bankers avoid easy mistakes, which always require redisclosures. This means customers can close on their homes more quickly!