nCino Banking UX: New Collateral Experience

Highlights 🔥

✅ After nCino's multiple years and attempts to "fix" Collateral, I successfully designed and deployed a streamlined and future-proofed experience that enabled impactful improvements without being limited by the codebase

✅ All users are now using the same interface, improving transparency and efficiency across the board.

✅ Each interface is much faster, with loading times being cut down by ~25-75% per click

✅ Accessibility was enhanced to improve WCAG compliance and provide a much more pleasant experience for screen readers

______________________

Overview 🧐

⏱ Time to complete: 2.5 months

Financial institutions must secure loans with something valuable to protect themselves from worst-case scenarios. This mitigates risk for the bank and improves borrowers' chances of getting the loan they want. As such, the house becomes "collateral" for the loan. (Some banks say assets, some say security, but the concept is the same.) nCino was originally used for business loans, but that complexity held nCino back with the introduction of consumer lending.

nCino's Collateral functionality was drastically different between use cases, leading to unnecessary confusion. Bandaid fixes bloated the codebase, impacted performance, and made it difficult to address major issues. End users got it the worst with a slow and unoptimized experience that costed time and money at all touchpoints.

Bankers needed a more pleasant, sensible, and performant solution that worked the same way no matter how they engaged with it. With a lot of cross-team collaboration and research, I created a completely new and unified Collateral experience.

______________________

How did I do it? 😎

Research

There were many limitations, so a viable strategy was paramount. Due to nCino's previous attempts, I thankfully wasn't starting my research from scratch. I spent a lot of time with Product Owners, Engineers, and Designers to ensure that needs were being met at as many touchpoints as possible. Journey maps helped me determine about how many steps it would take for users to get from start to finish (including steps outside of the interface).

Design

This functionality revolved around individual collaterals and groups of collaterals. Finding the right solution wasn't as simple as a good design. nCino's Design Systems team didn't have the bandwidth to vet LDS's latent accessibility landmines, nor did they have much time to make new patterns for nDS. Regardless, strict adherence to LDS was a requirement. Between iterations, I met with the Design team, Design Systems team, and Product teams to negotiate component usage that worked across all user and business cases.

Validation

Banking environments move quite slow, so I needed to plan for validation early. I had a list of hypotheses to validate against user feedback and ensured Product Owners had 5 clients to test my designs with. During our test interviews, we provided users with a prototype link that they could interact with and talk us through based on a script I provided. I had users rank each segment from 1-5 and explain why they felt that way. With that data, trends were identified to determine how best to iterate the design.

Deployment

As the design progressed, I collaborated with Product Owners and Engineers to determine which UI elements would end up in their pipeline and the order in which they'd work on them. I attended weekly meetings with Engineering as Design QA to address UI issues. Eventually, iteration slowed and QA became my focus.

______________________

Showcase 🎬

Improved Add/Edit Collateral Functionality

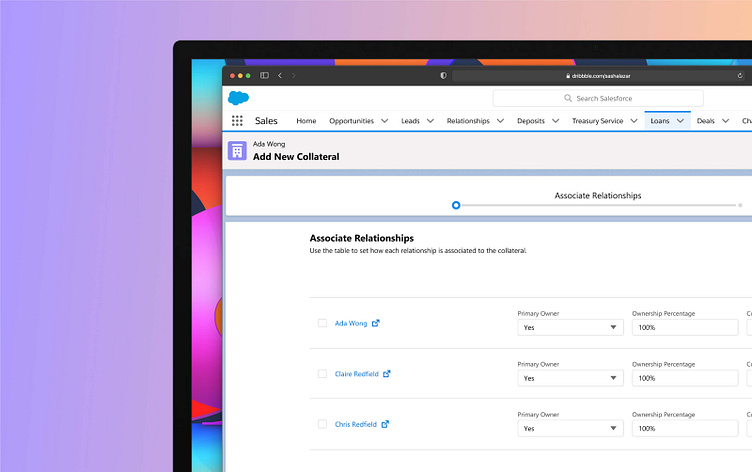

The Collateral experience I designed allowed bankers to easily add or edit any collateral assigned to a customer. nCino allows users to define how much collateral can be used globally or per loan. With improved utilization of system architecture, every piece of collateral can now be easily traced from the customer or the collateral itself.

Collateral Group Functionality

In addition, bankers can now group collateral, creating a collateral kit to be applied to loans for their customer's desired use. Improved visibility into customer relationships within the workflow makes it easier to understand how groups will impact the loans they are needed for.