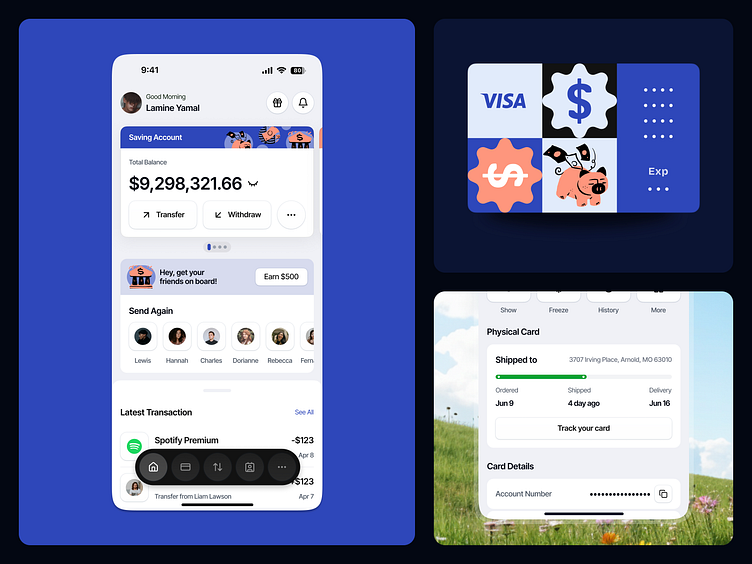

Delacoure - Mobile Banking App

Overview

Delacoure Mobile Banking App is an innovative platform designed to offer seamless, secure, and user-friendly mobile banking services. Targeted at digital-savvy users, the app provides a range of banking functionalities including fund transfers, bill payments, account management, and investment tracking. Delacoure aims to simplify financial management with real-time notifications, biometric security, and personalized financial insights, creating an all-in-one digital banking experience.

Challenges

User Expectations: Modern users expect fast, simple, and accessible banking solutions available 24/7.

Security Concerns: Cybersecurity threats pose a significant risk to users' data and financial transactions.

Complex Financial Tasks: Users often struggle with understanding complex banking services, managing their investments, and keeping track of finances without help.

Fragmented Experience: Users who bank with different institutions often struggle with transferring funds and accessing services across platforms, leading to frustration and a fragmented user experience.

How to solves

Smooth Onboarding

Easy, step-by-step signup with clear progress indicators and minimal inputs.

Organized Dashboard

Clean layout with quick-access buttons for core actions like transfers and bill payments.

Simple Navigation

Bottom bar for main actions, quick search, and breadcrumb trails for easy navigation.

Seamless Security

Biometric login, subtle security indicators, and two-factor authentication pop-ups.

Results

Increased User Engagement: The user-friendly design and integrated features have resulted in higher app engagement, with a 45% increase in daily active users.

Enhanced Security and User Trust: With multi-layer security, Delacoure has reported a 70% decrease in security-related incidents, building user trust.

Improved Financial Literacy and User Empowerment: Financial tools and personalized insights have helped users gain better control over their finances, with 60% of users reporting improved savings and spending habits.

Streamlined Multi-Bank Management: Cross-platform compatibility has led to a 30% reduction in user-reported friction with multi-bank management, increasing user satisfaction.

Mockup

Let's collaborate with us

🛍️ Download our Premium UI Kit on

Follow our pages and join the journey

Instagram | LinkedIn | Behance