Case Study: Omnichannel Conversational AI for Debt Collection

Overview

A leading fintech company in the BFSI sector struggled with debt collection, particularly in managing and reminding clients of ongoing EMI payments. With a large and diverse customer base, they relied on traditional channels for communication, making it challenging to reach and engage customers effectively. Missed or delayed EMIs were increasing, impacting both collection efficiency and overall financial health.

Problem Statement

The primary issues faced by the fintech company were:

Low Engagement Rates: Traditional methods were limited in reach, causing low response and engagement from customers.

Fragmented Communication: Relying solely on telephone calls and emails created fragmented experiences and missed opportunities to connect with customers through their preferred channels.

High Operational Costs: Manual follow-ups and scattered communication methods led to rising operational costs and inconsistent results.

Lack of Predictive Insights: There was no efficient way to predict customer response patterns, making it difficult to prioritize accounts and streamline collection efforts.

The company sought an innovative solution to enhance customer reach, improve response rates, and leverage AI to gain insights for more efficient debt collection.

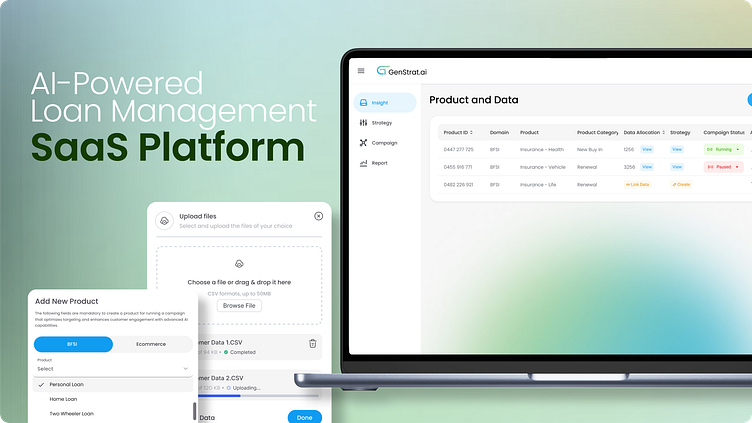

Solution: Omnichannel Conversational AI SaaS Platform

To address these challenges, GenStrat.ai developed a Conversational AI SaaS platform designed specifically for the fintech sector’s debt collection needs. The platform enabled the company to run automated, omnichannel campaigns using AI-powered conversation technology.

Key Features and Approach:

Omnichannel Communication:

Leveraged multiple channels such as telephony, WhatsApp, SMS, and email to reach customers.

Allowed the company to engage clients through their preferred communication method and increase response rates.

Reduced missed connections by delivering seamless follow-ups across channels.

Automated Campaign Management:

Designed to run and manage multi-touch campaigns with automated message scheduling.

Enabled the company to send reminders, follow-ups, and notifications across various channels without manual intervention.

Each campaign could be customized based on loan types, payment schedules, and customer segmentation for more personalized outreach.

Conversational AI for Real-Time Interaction:

Equipped with Natural Language Processing (NLP) to interact with customers conversationally, answer FAQs, and handle common queries related to EMI schedules and payment options.

AI-driven responses helped to keep customers engaged and provided easy access to information, improving satisfaction and response rates.

Predictive Analytics and Strategy Insights:

Integrated a strategy system powered by AI and Machine Learning, which analyzed customer response patterns.

Offered predictive insights to help the company prioritize accounts with a higher likelihood of delayed payments.

The platform’s analytics dashboard provided a real-time overview of campaign effectiveness, response rates, and collection progress.

Response Collection and Analysis:

Tracked customer responses and engagement on each channel, collecting valuable data for strategy refinement.

Used collected data to enhance future campaigns by segmenting customers based on their responsiveness and preferences.

AI-powered analytics provided actionable insights to identify optimal times and channels for contacting specific customer segments.

Results and Impact

The implementation of the GenStrat.ai Omnichannel Conversational AI platform led to substantial improvements:

Increased Customer Engagement: By using multiple communication channels, the fintech company observed a 35% improvement in customer engagement rates. Customers appreciated the flexibility of communication channels, which led to faster responses.

Enhanced Collection Efficiency: The platform’s predictive insights enabled the company to prioritize high-risk accounts, focusing efforts where they were most needed. Collection rates saw a 25% boost within the first three months.

Operational Cost Reduction: Automation reduced the need for manual follow-ups, cutting operational costs by 20%. Staff could focus on complex cases while the Conversational AI handled routine communication.

Improved Customer Satisfaction: With timely reminders and conversational support, customers reported a better experience managing their loan payments, contributing to positive brand sentiment and better customer retention.

Data-Driven Strategy Refinement: The analytics dashboard helped the company identify optimal outreach strategies, adjust messaging, and refine campaigns based on real-time data, enabling a continuous improvement cycle.

Conclusion

This AI-powered solution by GenStrat.ai transformed the debt collection process for the fintech company. By deploying an omnichannel approach combined with AI-driven insights, the company was able to reach customers more effectively, streamline operations, and boost collection efficiency. This case study highlights the powerful role that Conversational AI and predictive analytics can play in transforming customer engagement in the BFSI sector.

For more details, visit Genstrat.ai