Payment App! 💳📲

Hey Everyone! 👋

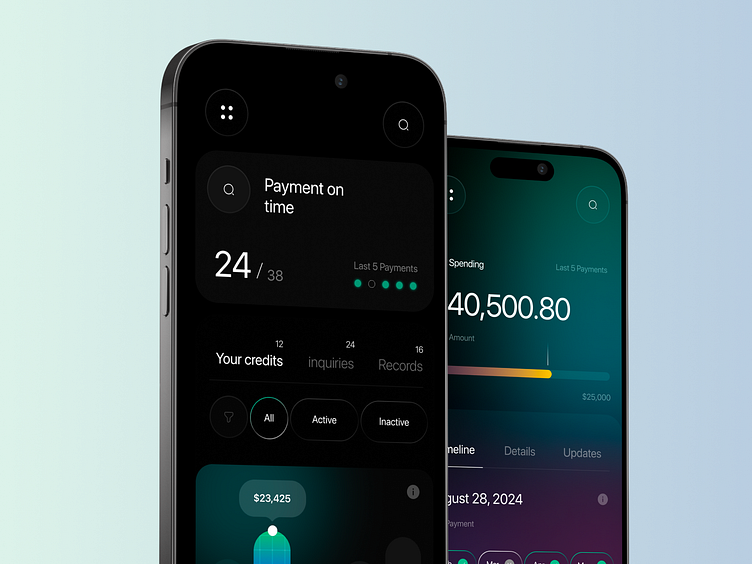

Super excited to share my latest UI/UX design concept for a Payment App! 💳📲 This app offers users a secure, fast, and seamless way to manage their payments, whether it’s for shopping, bills, subscriptions, or peer-to-peer transfers. 🔄 The focus of the design was to provide an intuitive interface with minimal steps, making every transaction smooth and hassle-free.

Hope you find it as intriguing as I do!

Dreaming up something amazing? Let's chat! Drop me a line at R.koohi99@gmail.com or connect with me on LinkedIn.

Let's make magic happen together! 🌈

Thinking of bringing your own vision to life?

I’m all ears! Reach out at R.koohi99@gmail.com or let's connect on LinkedIn for a brainstorming session. Together, we can craft something extraordinary! ✨

💬 Let's discuss!

I'm online in Telegram and discord to discuss about your project:

Telegram: http://t.me/doctordesign

Linkedin: https://www.linkedin.com/in/roohollah-koohi-a998a7b9/

Discord: https://discordapp.com/users/r.koohi99#8459

Email: R.koohi99@gmail.com

A Payment App serves as a digital solution for simplifying financial transactions, enabling users to send, receive, and manage money with ease. With the ever-growing adoption of mobile payments, these apps have become essential tools for consumers and businesses alike, providing a streamlined and secure way to handle transactions. Whether for peer-to-peer transfers, paying for goods and services, or managing subscriptions, a payment app must combine security, ease of use, and seamless integration with various financial systems and payment gateways.

1. User Interface (UI) and Experience (UX) Design

The UI design of a payment app must prioritize simplicity and clarity, with a clean, minimal aesthetic that allows users to navigate the app effortlessly. Key functionalities like money transfer, payment history, and wallet balance should be accessible within a few taps. Typography should be legible, and the design should focus on intuitive icons and clear labels. The UX should be optimized for fast transactions and minimal steps, offering features such as one-click payments, auto-fill forms, and QR code scanning for contactless payments. The process should be streamlined to prevent unnecessary friction, ensuring users can quickly make payments, check balances, and manage their finances on the go.

2. Security Features

Security is paramount when developing a payment app, as users are entrusting their financial data to the platform. Encryption technologies like SSL and AES should be in place to protect user data from unauthorized access. Implementing two-factor authentication (2FA) and biometric login (such as fingerprint scanning or face recognition) adds an extra layer of protection. Tokenization can be used for sensitive financial data, ensuring that no actual bank account details are stored on the device. Additionally, fraud detection algorithms can be integrated to monitor for suspicious transactions, ensuring that both users and merchants feel secure.

3. Payment Methods and Integrations

A payment app must support various payment methods to accommodate different user preferences. Integration with credit cards, debit cards, and bank accounts is a basic requirement, but the app should also support e-wallets, cryptocurrency transactions, and even buy now, pay later (BNPL) options to cater to a diverse range of users. Third-party payment gateways like Stripe, PayPal, or Square can facilitate seamless transactions, while enabling cross-border payments for international users. Additionally, the app should support in-app purchases for mobile games or subscriptions, making it a comprehensive solution for digital payments.

4. Peer-to-Peer (P2P) Transactions

One of the most common features in a payment app is the ability to send money directly to another person. P2P payments allow users to transfer funds to family, friends, or businesses with minimal effort. By leveraging bank account linking or digital wallets, users can easily send money via their phone number, email address, or QR code. This makes it ideal for splitting bills, paying rent, or sharing expenses. The transfer speed should be instantaneous or near-instant, and users should have the ability to track their transaction history, including the sender’s and recipient’s information, the amount transferred, and the date of the transaction.

5. Invoice and Bill Payments

For business owners and freelancers, a payment app can simplify the process of issuing invoices and receiving payments. The invoice generator should allow users to create customized, professional-looking invoices that include detailed information such as payment terms, service description, and due dates. Once an invoice is created, users should be able to send it directly to clients via email or through the app. Clients can then pay directly from the invoice using their preferred payment method. The app should support recurring payments for subscriptions or membership-based services, enabling businesses to automate revenue collection.

6. Transaction History and Analytics

A robust transaction history is a must-have feature for any payment app. Users should be able to view their spending patterns, payment records, and deposits in a well-organized dashboard. The history should be easily filterable by date, amount, or merchant, and each transaction should display relevant details such as the transaction ID, payment method used, and status (completed, pending, or failed). Furthermore, analytics tools can help users track their spending habits over time, offering insights into monthly budgets, expense categories, and overall financial health. This provides users with the tools they need to manage their finances more effectively.

7. Rewards, Loyalty, and Discounts

To enhance user engagement, a payment app can integrate features like rewards programs, loyalty points, and discounts. Users can earn points for using the app, making payments, or referring friends, which can then be redeemed for rewards such as cashback, coupons, or discounts with partnering merchants. This incentivizes continued use of the app and helps users save money. Additionally, integrating merchant offers and special deals within the app allows users to take advantage of discounts when shopping, paying bills, or making transactions. The rewards system should be easy to track, with clear information on how to earn and redeem points.

8. Cross-Border Payments and Currency Conversion

For global users, the payment app should facilitate cross-border payments with the ability to handle multiple currencies. This feature is especially important for users who send money internationally or shop from global e-commerce platforms. The app should offer automatic currency conversion based on real-time exchange rates, and allow users to send funds in their preferred currency. Transaction fees for international payments should be transparent, and the app should provide an estimate of the total cost before confirming the transaction. Integration with local payment methods in different countries will also make the app more accessible to a wider audience.

9. Customizable Notifications

To keep users informed, the payment app should have customizable notifications for different transaction activities. Users should receive real-time alerts for successful payments, incoming funds, low balances, and bill due dates. Additionally, push notifications can be sent for new rewards or special offers, keeping users engaged with the app. Email alerts can also be used for more detailed updates, such as monthly spending summaries or invoice reminders. Users should have control over the types of notifications they receive, allowing them to tailor the app to their preferences.

10. Integration with Digital Identity and Personalization

To enhance personalization, the payment app could integrate with digital identity services, allowing users to quickly authenticate themselves with single sign-on (SSO), face recognition, or biometric data. This ensures a quick, hassle-free login process and increases security. The app could also offer personalized experiences based on user preferences, such as transaction suggestions, tailored promotions, or reminders for regular payments. The ability to set financial goals and get personalized recommendations for saving or investing is also a key feature that enhances user engagement.

Conclusion

A payment app should offer a seamless, secure, and convenient solution for all types of financial transactions. From peer-to-peer payments and bill settlements to cross-border transfers and invoicing, it should cater to the needs of both personal users and businesses. With a strong emphasis on UI/UX design, security, and transaction flexibility, the app must provide an intuitive experience that makes managing finances easy and hassle-free. By integrating features such as loyalty programs, multi-currency support, and digital wallets, the app can offer a comprehensive solution for users, while enhancing engagement and building trust within a growing digital payment ecosystem.

.

💬 Let’s discuss!

I’m online in Telegram and Discord to discuss your project:

Telegram: http://t.me/doctordesign

Discord: https://discordapp.com/users/r.koohi99#8459

LinkedIn: www.linkedin.com/in/rooholla

Email: Hi@roohi.pro