Loan App! 📲💸

Hey Everyone! 👋

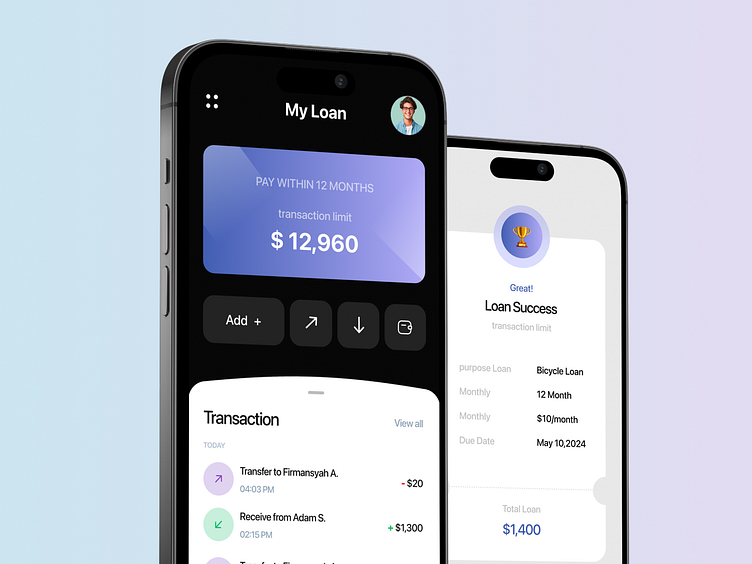

Super excited to share my latest UI/UX design concept for a Loan App! 📲💸 This app is designed to make borrowing money easy, fast, and transparent. Whether you need a personal loan, business loan, or mortgage, this app provides a seamless end-to-end loan management experience. 🏦 From applying for a loan to tracking repayments, everything is optimized to ensure smooth user interactions.

Hope you find it as intriguing as I do!

Dreaming up something amazing? Let's chat! Drop me a line at R.koohi99@gmail.com or connect with me on LinkedIn.

Let's make magic happen together! 🌈

Thinking of bringing your own vision to life?

I’m all ears! Reach out at R.koohi99@gmail.com or let's connect on LinkedIn for a brainstorming session. Together, we can craft something extraordinary! ✨

A Loan App is a mobile platform designed to help users manage, apply for, and track loans, offering an easy, user-friendly, and secure way to access credit. With the increasing demand for digital financial services, loan apps provide users with quick access to personal, business, or micro-loans without the need for traditional in-person applications. A well-designed loan app must combine advanced security, seamless user experience (UX), and comprehensive features to meet the needs of today’s tech-savvy consumers. By leveraging AI, machine learning, and big data, loan apps can offer faster approval processes, personalized loan options, and improved credit scoring systems, making it easier for users to manage their financial needs.

1. Intuitive UI/UX Design

A successful loan app prioritizes UI design that is clean, intuitive, and easy to navigate. The user journey begins the moment a user opens the app. From account creation to loan application, every interaction should be as seamless as possible. Responsive design ensures users can access and manage their loans from multiple devices, including smartphones and tablets.

A streamlined onboarding process with clear instructions, helpful prompts, and easy-to-read fonts ensures that users can quickly understand the loan application process. Elements such as loan calculators, repayment schedules, and eligibility checkers should be clearly visible and accessible. Additionally, using minimalist UI ensures the app remains free of unnecessary complexity, allowing users to focus on what matters most: their loan application and management.

2. Loan Application and Approval Process

The loan application process should be straightforward, with users able to apply for loans directly through the app. The app should allow users to enter basic information such as their name, address, income, and employment status, while providing a quick estimate of the loan amount they are eligible for based on their credit score and financial history. Integrating AI-driven algorithms can help speed up the application process by instantly assessing the user’s financial data and providing real-time loan approval decisions.

Loan apps can also integrate machine learning to predict the likelihood of loan repayment based on the applicant’s financial habits and credit behavior. This feature offers personalized loan offers that match the user’s financial profile, improving the chances of approval and ensuring that the loan terms are reasonable and affordable for the user.

3. Loan Terms and Customization

Once a loan is approved, a loan app should provide customized loan options tailored to the user’s needs. Whether it's a personal loan, auto loan, student loan, or mortgage, the app should offer flexible repayment plans, including options for short-term or long-term loans, low-interest rates, and installment periods that suit the user's financial capacity.

Users should have the ability to adjust and customize their loan terms, such as choosing monthly payment amounts, interest rates, or loan duration, based on their budgeting goals. This level of personalization ensures that users can confidently manage their repayments and avoid falling into debt.

4. Real-Time Loan Tracking

An important feature of a loan app is the ability to track the status of the loan from start to finish. Once the loan is disbursed, users can access detailed information on outstanding balances, payment due dates, payment history, and interest calculations through a user-friendly dashboard. Offering a loan tracker helps users stay on top of their payments and reduces the chances of missing deadlines.

A real-time loan tracker can display up-to-date information about the loan, including how much of the principal and interest has been paid and how much is remaining. Users can also receive push notifications for upcoming payments or overdue installments, keeping them informed and on track to avoid late fees or penalties.

5. Repayment Flexibility and Options

A well-designed loan app should offer multiple payment methods to give users flexibility when making repayments. Payment options could include bank transfers, credit card payments, mobile wallets (like Apple Pay or Google Pay), or cryptocurrency payments for more advanced users. The app should also integrate automatic payments for users who prefer to set up recurring payments directly from their linked bank account, ensuring that they never miss a payment.

For users experiencing financial difficulty, the app should offer options to reschedule repayments or request a loan extension, subject to the loan terms. Offering repayment flexibility ensures that users have the financial support they need during emergencies or unexpected situations.

6. Credit Score Integration and Personalized Loan Recommendations

A key feature of a loan app is credit score integration. The app should allow users to track their credit score and receive personalized loan recommendations based on their financial health. By connecting the app with credit bureaus or using AI-driven credit scoring algorithms, users can gain insights into their creditworthiness and receive loan options that are most likely to be approved.

The app should provide guidance on how to improve credit scores, offering tips on managing debt, making timely payments, and reducing credit card balances. Users can track their progress towards improving their credit scores and gain access to better loan terms as they build their financial reputation.

7. Loan Security and Data Privacy

Security is crucial in a loan app due to the sensitive nature of financial data. To ensure data privacy and secure transactions, the app must use industry-standard security measures such as encryption, two-factor authentication (2FA), biometric authentication, and secure payment gateways. This guarantees that users’ personal and financial data remains safe and protected from cyber threats.

Moreover, the app should comply with data protection regulations such as the General Data Protection Regulation (GDPR), ensuring that users’ data is not misused or shared with third parties without consent.

8. Customer Support and Assistance

A loan app should provide multiple avenues for customer support to help users with any questions or concerns. In-app live chat support, email support, and phone support can help users who are having trouble with the loan application, repayment process, or loan management features. Additionally, a well-organized help center with FAQs and tutorials can assist users in navigating the app’s features independently.

For more complex issues, users could schedule virtual consultations with a financial advisor or customer service representative to discuss loan options, repayment terms, or any concerns related to the loan application process.

9. Loan Pre-Approval and Eligibility Checker

A loan app should also feature a pre-approval tool to help users determine whether they are eligible for a loan before officially applying. This eligibility checker allows users to submit a few basic details and get an estimate of how much they can borrow and under what terms, without affecting their credit score. This feature enables users to make informed decisions before committing to a loan application, reducing unnecessary inquiries or rejections that could hurt their credit score.

10. Loan Disbursement and Withdrawal

Once approved, the loan disbursement process should be swift and hassle-free. The app should offer instant loan disbursement via direct bank transfers, digital wallets, or P2P lending networks. Users should be able to track their loan disbursement status in real time and receive instant notifications once the funds have been credited to their account. By making the loan disbursement process quick and transparent, users can access the funds they need without unnecessary delays.

Conclusion

A Loan App is a powerful tool for users to manage their personal finances, whether it’s applying for a new loan, tracking repayment progress, or receiving personalized loan recommendations based on their financial situation. By providing an intuitive, user-friendly design, real-time loan tracking, AI-driven recommendations, and flexible repayment options, a loan app can help users manage debt effectively and stay on top of their financial commitments. With robust security features, credit score integration, and personalized assistance, a well-designed loan app offers a comprehensive solution for users seeking quick and efficient access to credit in today’s digital economy.

💬 Let's discuss!

I'm online in Telegram and discord to discuss about your project:

Telegram: http://t.me/doctordesign

Linkedin: https://www.linkedin.com/in/roohollah-koohi-a998a7b9/

Discord: https://discordapp.com/users/r.koohi99#8459

Email: R.koohi99@gmail.com