Finance App! 📲💰

Hey Everyone! 👋

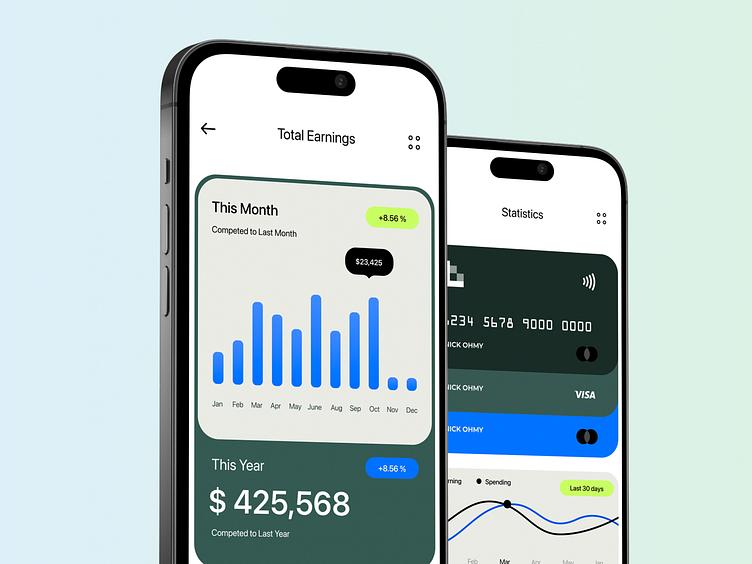

Super excited to present my latest UI/UX design concept for a Finance App! 📲💰 This app is designed to help users take full control of their personal and professional finances—whether it's tracking expenses, budgeting, or managing investments. 🧾📊 The goal was to create a simple and engaging experience with powerful tools to help users stay on top of their financial health.

Hope you find it as intriguing as I do!

Dreaming up something amazing? Let's chat! Drop me a line at R.koohi99@gmail.com or connect with me on LinkedIn.

Let's make magic happen together! 🌈

Thinking of bringing your own vision to life?

I’m all ears! Reach out at R.koohi99@gmail.com or let's connect on LinkedIn for a brainstorming session. Together, we can craft something extraordinary! ✨

💬 Let's discuss!

I'm online in Telegram and discord to discuss about your project:

Telegram: http://t.me/doctordesign

Linkedin: https://www.linkedin.com/in/roohollah-koohi-a998a7b9/

Discord: https://discordapp.com/users/r.koohi99#8459

Email: R.koohi99@gmail.com

A Finance App serves as a powerful tool for individuals and businesses to manage their financial activities, track expenses, monitor investments, and make informed decisions about their financial health. Whether you're aiming to streamline your personal finances, oversee a company’s budget, or track real-time investments in stocks, cryptocurrencies, or other assets, the app’s design must be intuitive, secure, and data-driven. Here's how a Finance App can be structured with key features and design principles to offer an exceptional user experience while utilizing popular industry trends.

1. Intuitive and Clean UI Design

The UI design for a Finance App should be clean, simple, and minimalistic to ensure users can access their financial data quickly without unnecessary clutter. The use of white space and intuitive navigation is crucial for easy interaction with features like expense tracking, investment monitoring, and budget planning. The dashboard UI should serve as the central hub, providing an overview of the user’s financial health with graphs, charts, and summary widgets such as total balance, monthly expenses, and available credit.

The hero section of the app could display a summary of key financial metrics, such as total savings, monthly income vs. expenses, and the current value of investments. Typography plays a vital role in ensuring legibility, with large, clear fonts for numbers and important data points, and smaller fonts for secondary information. Color coding can be used strategically to show positive or negative trends—green for profits and savings, red for losses or overspending, and yellow for caution.

2. Real-Time Data and Analytics

A Finance App should provide real-time data about a user’s financial activities. Integration with various financial institutions, such as banks, payment gateways, and investment platforms, allows users to track bank account balances, credit card statements, transactions, and even cryptocurrency investments in real-time. This can be done using secure API integrations with banks and third-party services.

Analytics tools should be embedded within the app to allow users to analyze their spending habits, categorize expenses, and generate financial reports. For example, the app could provide automated budgeting features, showing a breakdown of spending across categories like food, entertainment, utilities, and savings. Interactive graphs and charts that display monthly spending trends or year-on-year growth of investments would offer users an insightful view into their financial journey.

3. Investment Management & Cryptocurrency Tracking

For users interested in managing their investment portfolios, the Finance App should include features for tracking stocks, bonds, mutual funds, cryptocurrency holdings, and even emerging assets like NFTs. The investment dashboard should display the current value of all investments, real-time stock prices, and performance analysis over various timeframes (1-day, 1-week, 1-month, etc.).

To cater to cryptocurrency investors, the app could support the integration of cryptocurrency wallets and provide users with the ability to track popular coins like Bitcoin, Ethereum, and emerging altcoins. The app could feature live cryptocurrency exchange rates, investment trends, and alerts for price changes in cryptocurrency and blockchain markets.

Additionally, the app could integrate advanced tools for crypto trading, allowing users to buy and sell digital currencies within the app itself, acting as a crypto wallet app and investment platform.

4. Budgeting & Expense Management

The budgeting tool within the Finance App can help users allocate funds for specific categories and track their spending. With expense tracking capabilities, users can categorize each transaction (e.g., groceries, utilities, subscriptions) and set monthly spending limits for each category. Users can receive alerts when they approach or exceed these limits, ensuring they stay on track with their financial goals.

For expense management, the app could provide features like automatic expense categorization using machine learning or AI algorithms, which detect and label purchases based on merchants or types of spending. This makes it easier for users to understand where their money is going and identify areas where they can cut back.

5. Bill Payments and Recurring Transactions

The app should offer the ability to schedule bill payments and manage recurring expenses such as subscriptions to streaming services, utilities, insurance, and loan repayments. Users can link their bank accounts and credit cards for automatic bill payments, reducing the risk of missed payments and late fees.

Additionally, the app could offer push notifications to remind users about upcoming bills, loan payments, or subscription renewals, ensuring they never forget an important due date. The app could also track paid bills and offer a payment history section, so users can review their financial commitments over time.

6. Security and Data Privacy

In a Finance App, security is paramount. The app should implement industry-standard encryption protocols such as SSL/TLS to ensure that users’ financial data is transmitted securely. Multi-factor authentication (MFA) and biometric authentication (such as fingerprint or face recognition) are essential features to protect sensitive financial information.

User data, such as transaction history, account details, and personal information, must be stored securely, adhering to the latest data protection regulations such as GDPR. Transparency around how user data is handled and offering users control over their information builds trust and encourages adoption.

7. Personalized Financial Insights & Goal Setting

To enhance user engagement, the app could offer personalized insights based on the user's spending patterns, income, and financial goals. For example, if a user is saving for a major purchase, the app could track their progress and provide tips on how to reach their goal faster. It could suggest savings plans or investments based on the user’s financial profile.

The app could also include goal-setting tools where users can input specific financial goals, such as saving for a down payment on a house or planning for retirement. By tracking progress towards these goals, users can receive timely notifications and motivational updates to stay on track.

8. Tax and Credit Score Management

For users managing taxes, the app can integrate features that allow them to track taxable income, calculate estimated taxes, and organize receipts for tax filing. Providing users with an overview of their tax obligations for the year can help them plan for tax season and avoid surprises.

Credit score management can also be an essential feature. The app can give users regular updates on their credit score, along with tips for improving it, such as paying off outstanding balances or reducing credit utilization. Credit monitoring and alerts for major changes in credit score or report can also help users maintain their financial health.

9. Integrated Payment Systems

The payment system within the app should allow users to link their credit cards, debit cards, or PayPal accounts for easy fund transfers, purchases, and payment settlements. For those who deal with international transactions, multi-currency support can be a valuable feature. This feature will let users send or receive payments in various currencies while tracking the exchange rates in real time.

For individuals or businesses that regularly handle digital currencies, integrating crypto payment gateways would enable seamless transactions for services and products.

10. Push Notifications & Alerts

The app should be equipped with real-time notifications to alert users about key activities such as large transactions, budget limits exceeded, or investment performance updates. Personalized notifications can help users stay on top of their finances, ensuring they never miss an important event. For instance, users can receive alerts about stock price changes, upcoming bills, or when they have crossed a spending threshold.

Conclusion

A Finance App should provide a user-friendly, secure, and feature-rich platform for managing finances, tracking investments, and staying on top of budgeting and payments. By integrating real-time data, personalized insights, secure payments, and advanced tools for managing cryptocurrency and traditional assets, users can take control of their financial lives and make smarter decisions. Whether they are saving for the future, managing daily expenses, or building their investment portfolio, a well-designed Finance App helps users achieve their financial goals and maintain financial health. With features such as AI-driven analytics, budgeting tools, and investment tracking, the app becomes an indispensable tool for financial success.

.

💬 Let’s discuss!

I’m online in Telegram and Discord to discuss your project:

Telegram: http://t.me/doctordesign

Discord: https://discordapp.com/users/r.koohi99#8459

LinkedIn: www.linkedin.com/in/rooholla

Email: Hi@roohi.pro