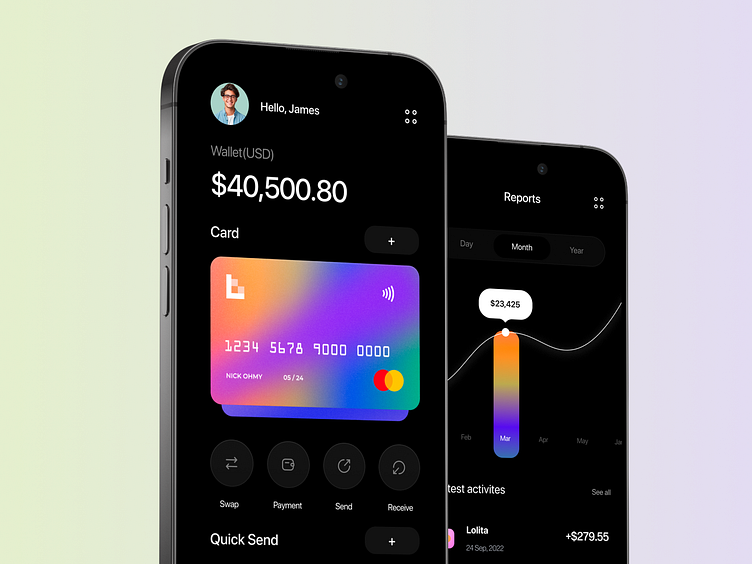

Digital wallet mobile ui application

Hey Everyone! 👋

Excited to introduce my latest design concept: a Wallet App for managing finances with ease and security! 💳📲 This app is designed to help users stay on top of their financial game by tracking expenses, making payments, and securely storing cards in one place. 🏦 The focus was on creating a sleek and intuitive interface with quick access to transaction history, spending insights, and budgeting tools.

Hope you find it as intriguing as I do!

Dreaming up something amazing? Let's chat! Drop me a line at R.koohi99@gmail.com or connect with me on LinkedIn.

Let's make magic happen together! 🌈

Thinking of bringing your own vision to life?

I’m all ears! Reach out at R.koohi99@gmail.com or let's connect on LinkedIn for a brainstorming session. Together, we can craft something extraordinary! ✨

💬 Let's discuss!

I'm online in Telegram and discord to discuss about your project:

Telegram: http://t.me/doctordesign

Linkedin: https://www.linkedin.com/in/roohollah-koohi-a998a7b9/

Discord: https://discordapp.com/users/r.koohi99#8459

Email: R.koohi99@gmail.com

A Wallet App is an essential mobile application that allows users to manage their financial transactions, store payment methods, and keep track of digital assets such as cryptocurrencies and loyalty cards. In today's increasingly digital world, these apps have become a vital tool for simplifying payments, enhancing security, and ensuring convenience in everyday financial activities. Whether used for online shopping, peer-to-peer transfers, or in-store purchases, a Wallet App brings together all forms of digital transactions under one easy-to-use platform. Here's how the design and functionality of a Wallet App can optimize the user experience:

1. Secure Digital Payments and Transactions

At its core, a Wallet App is designed to facilitate secure payments for both online and in-person transactions. Users can store various payment methods, including credit cards, debit cards, and bank accounts, ensuring that they can make purchases with ease. The app should integrate with popular payment systems like Google Pay, Apple Pay, or Samsung Pay, ensuring fast and secure mobile payments with just a tap.

To enhance security, the app should support biometric authentication (like fingerprint scanning or Face ID) to prevent unauthorized access. Additionally, two-factor authentication (2FA) and encryption protocols safeguard users’ sensitive financial data, protecting it from potential threats.

2. Support for Cryptocurrencies

With the rise of cryptocurrencies, many users now seek to manage their digital assets directly from their wallet apps. A good Wallet App should seamlessly integrate with crypto wallets, allowing users to store and manage popular cryptocurrencies like Bitcoin, Ethereum, and Litecoin. Real-time crypto price tracking, market insights, and the ability to buy, sell, or exchange cryptocurrencies should be readily accessible within the app.

To simplify crypto transactions, the app can also allow users to make crypto-to-fiat exchanges (e.g., converting Bitcoin to USD) and provide a secure platform for peer-to-peer crypto transfers. Integrating with popular blockchain networks like Ethereum, Solana, or Binance Smart Chain could further enhance the app's versatility for crypto users.

3. Seamless User Interface (UI) and Experience (UX)

The UI design of a Wallet App needs to be clean, intuitive, and accessible. Users should be able to quickly navigate between features, whether they are checking their balance, reviewing their transaction history, or adding a new payment method. Simple, minimalistic design trends work best in this case to avoid overwhelming users with too many options on the screen. Typography, color palettes, and iconography should be consistent and aligned with the app's brand identity to ensure a polished, professional look.

In addition, UX design should prioritize a smooth and fast user experience, with animations that are fluid and not disruptive. For example, when adding a new payment method, the process should be fast, easy, and secure. Providing users with real-time notifications about transaction status, including successful payments, declined transactions, or fraud alerts, enhances the app’s usability and trustworthiness.

4. Multi-Currency Support and International Transactions

A Wallet App should ideally support multi-currency capabilities for users who travel internationally or handle different types of currency. Offering real-time currency exchange rates and automatic conversions between USD, EUR, GBP, or any local currency makes it easy for users to perform global transactions. For example, users should be able to pay in their preferred currency while traveling abroad or exchange currencies directly within the app.

The app can also feature global payment methods and transaction tracking in various countries. By supporting a wide range of currencies and payment systems, the app ensures users can access their funds wherever they are, making it an essential tool for digital nomads or frequent travelers.

5. Peer-to-Peer (P2P) Transfers and Bill Payments

Many Wallet Apps support peer-to-peer (P2P) transfers, allowing users to send money directly to friends or family. This feature eliminates the need for cash or checks, making it easy to split bills, pay back a friend, or send a gift. Integrating with other P2P payment systems like Venmo or Zelle can make this functionality more accessible to a wider user base.

In addition to P2P transfers, the app can also include bill payment features to help users manage recurring expenses such as subscriptions, utility bills, and rent payments. Providing an option for auto-payment can help users avoid late fees and keep track of their finances without the stress of remembering due dates.

6. Loyalty Cards and Offers

Another valuable feature of a Wallet App is the ability to store loyalty cards and discount coupons. Users can save cards for their favorite stores, supermarkets, or coffee shops and access them easily when making in-store purchases. The app can automatically apply relevant discounts, redeemable points, or coupons during checkout.

This feature helps users streamline their shopping experience and ensures they never miss out on savings. By integrating with marketing tools and offers, the wallet can send push notifications when new discounts or promotions are available for the user’s stored loyalty cards, enhancing their overall shopping experience.

7. Expense Management and Financial Insights

A great Wallet App should offer tools for managing finances and monitoring spending. Expense tracking features allow users to categorize their spending, track monthly budgets, and analyze where their money is going. Visual reports such as charts, graphs, and spending summaries can help users stay informed about their financial health and identify areas where they can save.

For users looking to optimize their finances, the app can integrate with AI-powered insights that offer personalized suggestions, such as ways to save money, how to allocate funds, or tips for improving credit scores.

8. Rewards and Cashback Programs

Integrating rewards programs and cashback options is an attractive feature for users who frequently make purchases through the wallet. The app can partner with various retailers to offer users exclusive deals, special promotions, or cashback rewards for using the wallet for transactions. This can include earning points for every purchase or receiving a percentage of cashback for spending with partnered merchants.

9. Data Privacy and Security

Security is paramount in any digital wallet. The app must adhere to the highest standards of data protection and privacy. Implementing multi-layered security measures like end-to-end encryption, two-factor authentication, and secure payment gateways will ensure that users' sensitive financial information is safe from hacking or identity theft.

Additionally, the app should offer fraud alerts and account monitoring features, keeping users informed of any suspicious activity in real-time. Data privacy policies should be clearly communicated to users, and the app must comply with relevant regulations like GDPR (General Data Protection Regulation) and PCI DSS (Payment Card Industry Data Security Standard).

10. Seamless Integration with Banks and Financial Institutions

A Wallet App should offer smooth integration with users’ bank accounts and financial institutions, allowing for easy transfers, balance checks, and bill payments. Users should be able to link their bank accounts and view real-time balances without the need for third-party services.

The app could also include savings tools, such as automatic transfers to savings accounts, or the option to set up round-ups, where purchases are rounded to the nearest dollar and the difference is saved. Such features help users manage their finances more efficiently.

Conclusion

A Digital Wallet App is more than just a payment tool; it’s a comprehensive platform for managing all aspects of personal finance, from transactions and crypto management to expense tracking and rewards programs. With the right combination of UI/UX design, security measures, and innovative features, a Wallet App can simplify the financial lives of its users, making it easier to pay, save, invest, and manage money—anytime, anywhere. By incorporating smart integrations, personalized financial insights, and multi-currency support, the app can stand out in a competitive market and provide a seamless experience for all users.

.

💬 Let’s discuss!

I’m online in Telegram and Discord to discuss your project:

Telegram: http://t.me/doctordesign

Discord: https://discordapp.com/users/r.koohi99#8459

LinkedIn: www.linkedin.com/in/rooholla

Email: Hi@roohi.pro