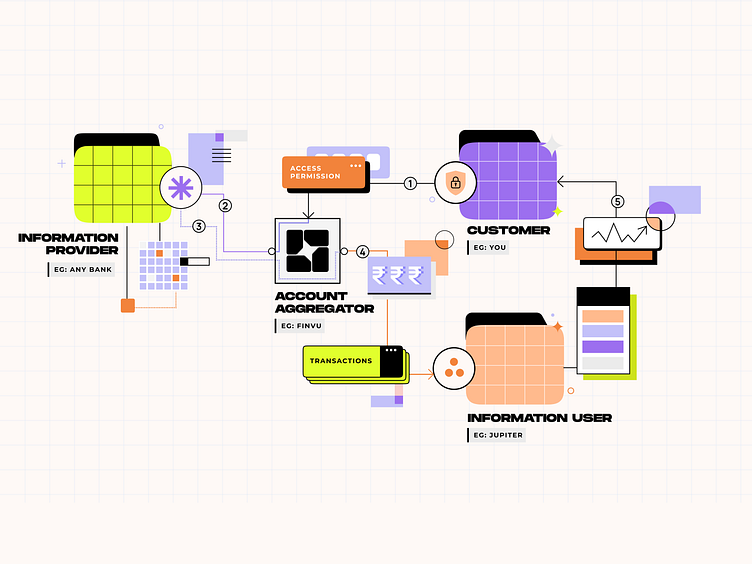

Account Aggregator flow chart

Account aggregator

An RBI-regulated financial data aggregator allows users to securely import their bank data into other apps. It provides a comprehensive view of finances, enhances budgeting, and offers insights while ensuring data privacy and security. Users control data sharing, making personal finance management easier and more efficient.

A customer allows an account aggregator partner - AA partner ( for example - Finvu ) to access their data from any financial information provider - FIP ( for example - any bank) via OTP verification.

The Account aggregator sends a request to the FIP to access the users data.

The FIP encrypts and sends the user data to the AA partner.

The AA partner sends financial information like balance, transactions etc to a financial information user - FIU ( for example - any fintech app like Jupiter or Cred). This data gets updated daily.

The FIU interprets this data into insights and shows that back to the user.