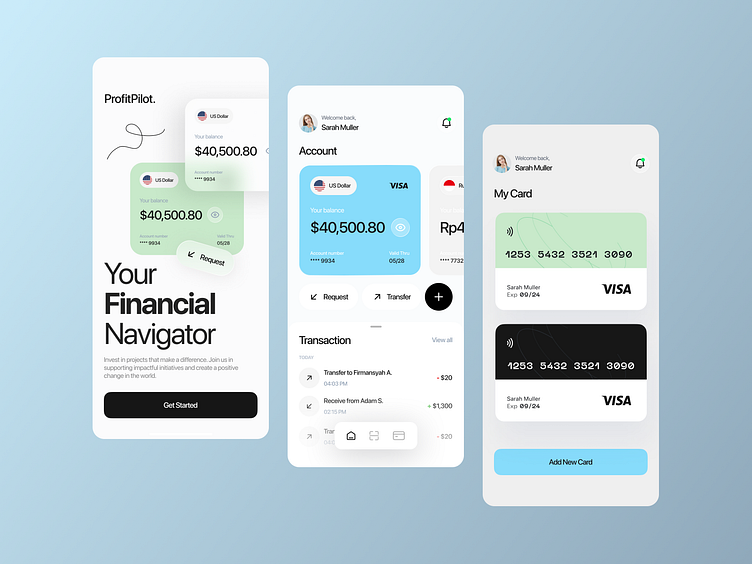

Finance, Crypto, Wallet Mobile Ui

Hey Everyone! 👋

Excited to unveil my latest project: a Finance App UI/UX concept designed to simplify your financial journey! 💼💸 Whether it's budgeting, tracking expenses, or managing investments, this app has got you covered. 📊✨ With a sleek interface and intuitive features, staying on top of your finances has never been easier.

Let's make managing money a breeze together! 💪💰

Hope you find it as intriguing as I do!

Dreaming up something amazing? Let's chat! Drop me a line at R.koohi99@gmail.com or connect with me on LinkedIn.

Let's make magic happen together! 🌈

Thinking of bringing your own vision to life?

I’m all ears! Reach out at R.koohi99@gmail.com or let's connect on LinkedIn for a brainstorming session. Together, we can craft something extraordinary! ✨

💬 Let's discuss!

I'm online in Telegram and discord to discuss about your project:

Telegram: http://t.me/doctordesign

Linkedin: https://www.linkedin.com/in/roohollah-koohi-a998a7b9/

Discord: https://discordapp.com/users/r.koohi99#8459

Email: R.koohi99@gmail.com

A Finance App is a powerful tool designed to help users manage their finances, track their spending, save money, invest, and stay financially organized—all from the convenience of their mobile devices. With the growing importance of financial literacy and the increasing reliance on smartphones, finance apps have become an essential part of everyday life for individuals seeking to take control of their financial health. Whether it’s for personal finance management, budgeting, investing, or tracking expenses, a finance app can help users stay on top of their financial goals with ease and efficiency.

Key Features of a Finance App:

1. Personalized Budgeting and Expense Tracking

A finance app allows users to set personal budgets and track their spending in real time. This feature is essential for anyone looking to maintain financial discipline and avoid overspending.

Budget Creation: Enable users to create detailed monthly or weekly budgets based on income, expenses, and financial goals. Categories could include groceries, transportation, entertainment, and savings.

Expense Tracking: Automatically track and categorize all transactions, whether they come from debit cards, credit cards, or online payments. The app should provide an overview of how much money is being spent in each category and alert users when they’re nearing their budget limits.

Customizable Categories: Users should be able to add custom categories to track specific spending habits, such as subscriptions, loans, or emergency expenses.

2. Bill Reminders and Payment Scheduling

A finance app should include features that allow users to set up bill reminders and automate payments, helping them avoid late fees and missed due dates.

Bill Reminders: Users can set reminders for upcoming bills, such as mortgage payments, utilities, credit card bills, and subscriptions, ensuring they never miss a payment.

Payment Scheduling: Offer an option to schedule payments directly from the app, allowing users to automate recurring expenses like rent, utilities, or monthly subscriptions.

Overdue Alerts: Send notifications if a payment is overdue or about to be due, helping users stay on top of their financial obligations.

3. Investment Management

For users looking to grow their wealth, a finance app should offer tools to manage investments and track portfolio performance, including stocks, bonds, mutual funds, and even cryptocurrency.

Investment Portfolio Tracker: Provide users with a dashboard to track the performance of their investments in real time, including gains, losses, and overall portfolio value.

Investment Insights: Offer personalized insights and recommendations based on the user’s risk tolerance, financial goals, and market trends. This could include tips on diversification, rebalancing, and asset allocation.

Cryptocurrency Support: With the rise of digital currencies, integrating features to track popular cryptocurrencies like Bitcoin, Ethereum, or even NFTs can attract users interested in crypto investing.

4. Savings Goals and Financial Planning

A finance app should also help users set financial goals and track their progress toward achieving them, whether for an emergency fund, a down payment on a house, or a vacation.

Savings Goals: Allow users to create specific savings goals, such as saving for a car, vacation, or education, and track their progress over time. The app can show how much has been saved and how much is left to reach the goal.

Automated Savings: Offer features that automate savings by setting up a round-up system (where small transactions are rounded up to the nearest dollar and saved) or allowing users to schedule automatic transfers to their savings account.

Financial Milestones: Celebrate milestones achieved towards savings goals, such as reaching 50% of a goal, to motivate users to keep saving.

5. Debt Management and Loan Tracking

Managing debt is a key part of financial health, and a finance app should help users track and manage their loans, credit card debt, student loans, and mortgages.

Debt Tracker: Allow users to track all their debts in one place, including credit card balances, student loans, personal loans, and mortgages. The app should display total debt, interest rates, and payment due dates.

Debt Repayment Plan: Offer users strategies for paying down debt, such as the debt snowball method or the debt avalanche method, and provide them with personalized repayment schedules.

Loan Amortization Calculator: Include a feature that calculates how long it will take to pay off a loan, along with interest costs, helping users understand their financial commitments.

6. Credit Score Monitoring

Understanding and improving one’s credit score is crucial for financial success. A finance app should include credit score tracking and tips for improving it.

Credit Score Insights: Provide users with access to their credit report and credit score, and offer insights into how to improve it.

Credit Utilization Tracker: Help users keep track of their credit card balances in relation to their credit limits, as this has a major impact on credit scores.

Alerts for Credit Changes: Notify users of any changes to their credit report, such as new credit inquiries, changes in their credit score, or late payments, allowing them to stay informed and take action if needed.

7. Tax Management and Filing

Tax season can be stressful, but a finance app can simplify the process by helping users track their taxable income, deductions, and expenses throughout the year.

Tax Document Storage: Allow users to store important tax-related documents, such as W-2s, 1099 forms, and receipts for tax-deductible expenses.

Tax Estimator: Help users estimate their potential tax liability based on their income and expenses, providing an early estimate of how much they may owe or how much of a refund they can expect.

Tax Filing Integration: Some apps may even allow users to file their taxes directly through the app or integrate with popular tax filing software like TurboTax or H&R Block.

8. Security and Privacy Features

Since finance apps handle sensitive financial information, security and privacy should be top priorities.

Multi-Factor Authentication (MFA): Implement multi-factor authentication (MFA) to ensure that only authorized users can access the app and their financial information.

Data Encryption: Use end-to-end encryption to protect users’ financial data from unauthorized access, ensuring that all personal information is stored securely.

Privacy Settings: Allow users to control their data privacy, ensuring they can opt out of any data-sharing practices or limit how their data is used by third-party services.

9. User-Friendly Interface

To ensure users stay engaged and make the most of the app, the user interface (UI) should be intuitive, clean, and easy to navigate.

Simple Dashboard: Provide a simple, clean, and easy-to-read dashboard that aggregates the user’s financial data in one place, including balances, budgets, and goals.

Customizable Themes: Allow users to choose a theme or color scheme that suits their preferences, enhancing the app’s user experience.

Actionable Insights: Offer easy-to-understand graphs, charts, and recommendations based on the user’s financial situation, helping them make informed decisions.

10. Integration with Banks and Financial Institutions

To provide a seamless experience, a finance app should integrate with multiple financial institutions and payment systems.

Bank Account Integration: Allow users to connect their bank accounts, credit cards, and e-wallets directly to the app for easy tracking of income and expenses.

Transaction Syncing: Automatically sync transactions from linked accounts, credit cards, and digital wallets, reducing manual entry and minimizing errors.

Payment Integration: Support bill payments, peer-to-peer transfers, and even crypto transactions, making the app a central hub for all financial transactions.

Conclusion:

A finance app is a powerful tool that brings financial management to the fingertips of users, providing them with a wide range of features to help them budget, save, invest, manage debt, and achieve their financial goals. With tools for expense tracking, investment management, savings goals, debt repayment, and credit score monitoring, users can gain complete control over their financial lives. Additionally, the app’s security features, such as multi-factor authentication and encryption, ensure that users' financial data remains safe and protected. By integrating with banks, payment systems, and even cryptocurrency wallets, a finance app becomes the ultimate companion for individuals looking to secure their financial future.

.

💬 Let’s discuss!

I’m online in Telegram and Discord to discuss your project:

Telegram: http://t.me/doctordesign

Discord: https://discordapp.com/users/r.koohi99#8459

LinkedIn: www.linkedin.com/in/rooholla

Email: Hi@roohi.pro