Case Study - Prosperify : Take Control of Your Financial Future

Problem Statement:

Many individuals struggle to effectively manage their personal finances due to a lack of visibility into their overall financial health, confusion about investment options, and difficulty in tracking expenses and bill payments across multiple platforms.

Goals and Objectives:

Develop a user-friendly personal finance web app that provides comprehensive visibility into users' net worth, investments, expenses, and cash flow.

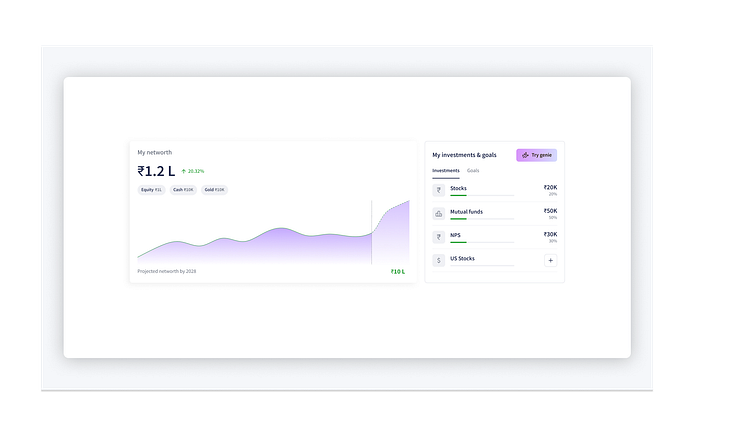

Implement smart AI features, such as Genie, to assist users with investment decisions, goal setting, and answering financial queries.

Utilize the goal gradient effect to prioritize investments and financial goals, promoting user engagement and encouraging further investment.

Integrate smart calculator and recommendation features powered by ML and predictive analysis to simplify investment decision-making and reduce cognitive load.

Provide users with insights into their cash flow, expenses, and bill payments to enable better financial management and decision-making.

Offer smart nudges to encourage users to invest their balances into fixed deposits and mutual funds for higher returns.

Centralize bank transactions and balances within the app to streamline financial tracking and reduce the need for multiple banking apps.

Implement bill reminder functionality to help users stay on top of pending bills and avoid penalties, reducing cognitive load and financial stress.

Enable users to analyze their cash flow, earnings, investments, and expenses to make informed decisions and improve their financial health.

Utilize the price anchoring effect to promote the adoption of Systematic Investment Plans (SIPs) and wealth-building strategies among users.

Provide options for users to explore and purchase insurance policies to protect their families and assets, while also enabling easy tracking of all policies within the app.

Quantitative Research:

Quantitative research will involve gathering data on user engagement, app usage patterns, and financial behaviors. Surveys and analytics will provide insights into user preferences, pain points, and satisfaction levels. Key metrics to track include user adoption rates, average session duration, frequency of interactions with smart AI features, completion rates for bill payments, and user feedback on the effectiveness of financial insights provided by the app. This quantitative data will inform ongoing improvements and optimizations to the personal finance web app.