Case Study ( Part 1 - User Research ) - FinTech

Problem Statement:

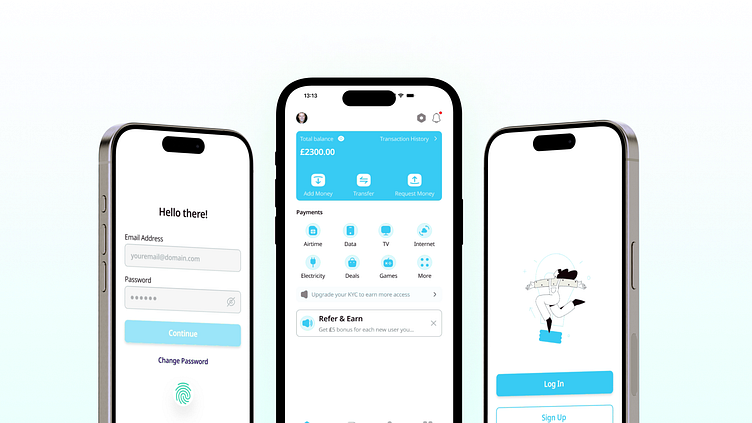

The goal is to create a banking app UI that enhances user experience and encourages effective money management, addressing the challenges users face in navigating financial transactions and accessing essential banking services.

Goals and Objectives:

The objective is to develop a user-friendly interface that empowers users to manage their finances efficiently, promoting financial literacy and facilitating seamless banking transactions. The goal is to enhance user satisfaction, confidence, and motivation in using the app for various banking needs.

Quantitative Research:

Quantitative research revealed significant gaps in users' engagement with banking apps, with a majority not meeting recommended guidelines for financial management. Primary research included surveys targeting users aged 18-45, revealing that a large portion of respondents had limited experience with effective money management through digital platforms. Secondary research highlighted statistics indicating that while a significant percentage of individuals meet aerobic exercise guidelines, only a fraction meet strength training recommendations. This underscores the opportunity to specifically address the challenges users face in managing their finances effectively through digital banking solutions.

User Research

User Research , Goals, Questions, KPIs, Participants & Survey

Research Methodology:

Our user research process was multifaceted, starting with Card Sorting to understand how users categorize banking features and functionalities. Interviews and Surveys provided qualitative and quantitative data, respectively, shedding light on user behaviors, preferences, and pain points. Empathy Mapping allowed us to delve deeper into the emotions and experiences of our users, while SWOT Analysis helped identify strengths, weaknesses, opportunities, and threats in the banking app landscape. User Personas synthesized our findings into archetypal representations of our target audience, guiding our design decisions. Usability Testing sessions provided real-world feedback on our app prototypes, allowing us to refine and improve the user experience iteratively.

App Development:

Informed by our user research findings, we embarked on the development of our banking app. Features and functionalities were meticulously designed to address user needs and preferences identified during the research process. From intuitive navigation based on Card Sorting results to security features informed by SWOT Analysis, every aspect of the app was crafted with the user in mind.

Conclusion:

Through rigorous user research and iterative design, we have created a banking app that is truly user-centric and tailored to the needs of our target audience. By leveraging techniques such as Card Sorting, Interviews, Surveys, Empathy Mapping, SWOT Analysis, User Personas, and Usability Testing, we have gained deep insights into user behavior and preferences, which have informed every aspect of our app development process. We are confident that our app will redefine the banking experience for our users, providing them with a seamless, intuitive, and secure platform to manage their finances effectively.