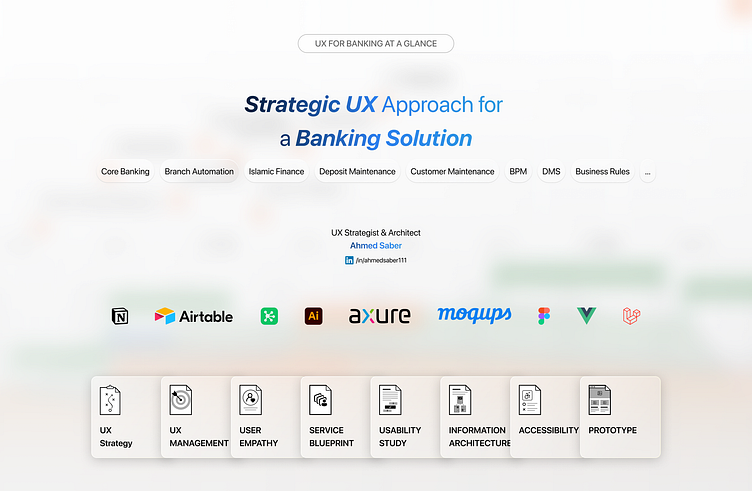

Strategic UX Approach for a Banking Solution

Case Overview

Design a next-generation banking platform that integrates all business functionalities of "Core Banking", "Branch Automation", "Islamic Finance", "Trade" and much more into a single, unified interface. The solution seeks to replace fragmented systems accumulated over more than 30 years.

In this case study, we delve into the specifics of the UX redesign, exploring the challenges faced, the strategies implemented, and the profound impact of these changes on users and the business as a whole. Through this project, we aimed to set a new standard in user experience for the banking industry, demonstrating the pivotal role of UX in driving technological adoption and customer loyalty.

Drivers

Omni-channel Banking: and the rising of consumer expectations.

Digital Transformation in Financial Sector: the emergence of new technologies such as AI, and cloud infrastructure that can enhance scalability, efficiency and user experience.

Regulatory Compliance and Security: updated regulations requiring stringent data protection and privacy measures, driving changes in how data is managed and protected.

Competitive Pressure: The need to stand out in a crowded market by offering superior customer experiences and innovative services.

Data-Driven Decision Making: leverage analytics to provide personalized services and improve decision-making processes.

Lack of Usability.

Barriers

Legacy Systems & Technical Complexity: designing a user-friendly interface that accommodates all functionalities of complex banking operations involves significant technical challenges.

Cultural Resistance: traditional banking methods may resist new technologies and processes, hindering adoption and effectiveness.

Development of an

Enterprise UX Strategy

♟️ UX Strategy

Tackling the transformation of the fragmented and outdated user experiences into a cohesive, intuitive, and accessible platform requires a solid UX strategy that stands out.

This strategy should be centered around a holistic approach, encompassing design thinking principles, technological integration, and business alignment. The goal is not only to improve the user interface but also to enhance the overall user journey across different banking modules.

A) Declare UX Objectives

Enhance User Satisfaction: improve the overall usability of the system to increase user satisfaction.

Increase Operational Efficiency: streamline processes and interfaces to reduce redundancies and operational costs.

Ensure Accessibility Compliance: comply with web accessibility standards, WCAG 2.1, by incorporating keyboard navigation feature, and high-contrast visual elements.

Support Business Goals: align the UX improvements with broader business objectives, such as digital transformation, omni-channel and market expansion.

Enhance Analytical Capabilities: improve decision-making and personalized service offerings through better data insights.

B) Implementation Challenges

In crafting an enterprise UX strategy, it's imperative to address the formidable challenges stemming from the fragmentation inherent in the banking ecosystem. This fragmentation has given rise to disjointed user experiences and operational inefficiencies spanning various banking functions, a matter of profound significance that cannot be overstated.

Therefore, as we embark on formulating an enterprise UX strategy, it is paramount to confront these challenges head-on. This entails fostering collaboration and alignment across diverse stakeholders, including IT teams, product managers, designers, and business leaders. By breaking down silos and fostering cross-functional synergy, we can cultivate a unified vision for the user experience that transcends individual banking functions and channels.

To tackle these UX challenges, several key considerations come to the forefront:

UX maturity: Promote & advocate UX activities

DesignOps

Design Thinking: Identifying +42 user profile’s problems to resolve.

Reduce complexity

Accessibile interface

Keyboard navigation

C) Strategy Key Components

→ User Research and Empathy

User Profiling and Persona Development: Developed detailed user profiles and personas based on extensive user research to understand the needs, behaviors, and motivations of different user groups, including bank staff and customers.

Empathy Mapping: Conducted empathy mapping sessions to gain deeper insights into the user's experiences and identify emotional drivers and pain points.

→ Co-Creation

Ideation Workshops: Facilitated ideation workshops with stakeholders from various departments to ensure a cross-functional approach to solution development.

Co-creation Sessions: Engaged with users through co-creation sessions to generate ideas and feedback early in the design process, fostering a sense of ownership and acceptance among users.

→ Accessibility Integration

Developed an integration plan to embed accessibility features, such as keyboard navigation, into every aspect of the user interface.

All content should comply with Web Content Accessibility Guidelines WCAG.

→ Strategic Implementation

Phased Rollout: Adopted a phased approach to the rollout of the redesigned platform to manage risk and allow for incremental improvements based on user feedback.

Feedback Loops: Established continuous feedback loops with end-users and stakeholders to ensure the solution evolves in line with user needs and business objectives.

→ Performance Metrics and Benchmarking

KPI Development: Defined key performance indicators (KPIs) related to usability, satisfaction, and efficiency to measure the success of the UX strategy.

Benchmarking: Set benchmarks against current as-is banking systems to gauge the platform’s performance and identify areas for improvement.

♺ DesignOps Paradigm

The DesignOps focuses on streamlining and optimizing design processes by integrating operations, systems, and teams. This approach is instrumental in addressing scalability, efficiency, and collaboration challenges in such a large-scale project, as it brings several benefits:

Improve Collaboration: facilitate better teamwork across design, development, and business units to ensure that UX decisions are well-informed, strategic, and aligned with business objectives.

Standardize Processes: create standardized workflows and protocols to enhance the consistency and quality of design outputs across various touchpoints in the new banking platform.

Enhance Speed & Efficiency: reduce the time from concept to implementation by streamlining design processes and leveraging automation where possible.

Ensure Governance and Compliance: Integrate compliance checks and balances throughout the design and development processes to meet regulatory standards without compromising on innovation or user experience.

📖 User Study & Benchmarking

Proposing a systematic approach aimed at achieving a thorough understanding of users, encompassing their needs, behaviors, and preferences. It serves as a guiding framework for conducting research activities throughout the entirety of the design and development process.

The study were designed to achieve the following objectives:

Understand User Behaviors and Preferences: gain a deep understanding of how various user profiles interact with the banking platform and identify their specific needs, preferences, and pain points.

Validate Design Assumptions: use empirical data gathered from user interactions to validate or refine the design hypotheses developed during the initial stages of the redesign process.

Benchmarking Development: entails creating benchmarking KPIs based on existing as-is legacy systems to evaluate performance, identify strengths and weaknesses, and establish key performance indicators (KPIs). Later on, these benchmarks should be utilized to evaluate and enhance the new solution, ensuring its alignment with user needs and preferences while also striving for optimal performance.

Ensure Continuous Improvement: establish a baseline for ongoing evaluations of the UX to ensure the platform continues to meet and exceed user expectations over time.

Hypothesis-driven Design

Executing the enterprise UX strategy, at its heart lies a commitment to understanding and empathizing with users, as we navigate the intricate landscape of banking business and technology. The problem declaration acts as our guiding star, illuminating the challenges and opportunities that shape our design journey. we navigate the complexities of the banking landscape, crafting solutions that not only solve problems but also elevate the user experience to unprecedented heights.

Hypothesis worksheet involves crafting hypotheses regarding user behavior, needs, and preferences, which act as the cornerstone for subsequent design decisions and experiments. Business subject matters and architecture teams along with UX team are urged to articulate their assumptions with clarity and precision. Subsequently, these assumptions undergo rigorous validation through rapid experimentation and testing, employing methods like A/B testing, prototyping, and gathering insights from stakeholders feedback.

Areas of Improvements

Workflow & Business Process Enhancement: simplify and streamline workflows to enhance user efficiency and reduce operational complexity.

Expected Impact: Improved processing times, reduced manual errors, and enhanced user satisfaction through more intuitive and faster banking processes.

Decision Support Systems: enhance the decision-making capabilities of bank staff by providing them with timely and relevant data. Develop advanced analytics tools and dashboards that provide critical information at a glance, such as customer risk profiles, transaction histories, and other relevant financial indicators. These tools are designed to support both strategic and operational decision-making.

Expected Impact: Increased accuracy in decision-making, leading to better customer service, more targeted product offerings, and improved financial performance.

Contextual and Personalized User Experience: deliver a more personalized and context-aware user experience across all banking channels.

Expected Impact: Enhanced user engagement, increased customer retention, and higher customer satisfaction scores.

Reduction of System Complexity: reduce the complexity inherent in the banking system to make it more accessible and easier to use for both customers and staff.

Expected Impact: Decreased training time for new users, reduced support calls, and improved efficiency in daily operations.

Enhancing Accessibility and Inclusivity: ensure that the banking platform is accessible to all users, including those with disabilities.

Expected Impact: Broader user base, compliance with legal standards, and enhanced corporate image as an inclusive service provider.