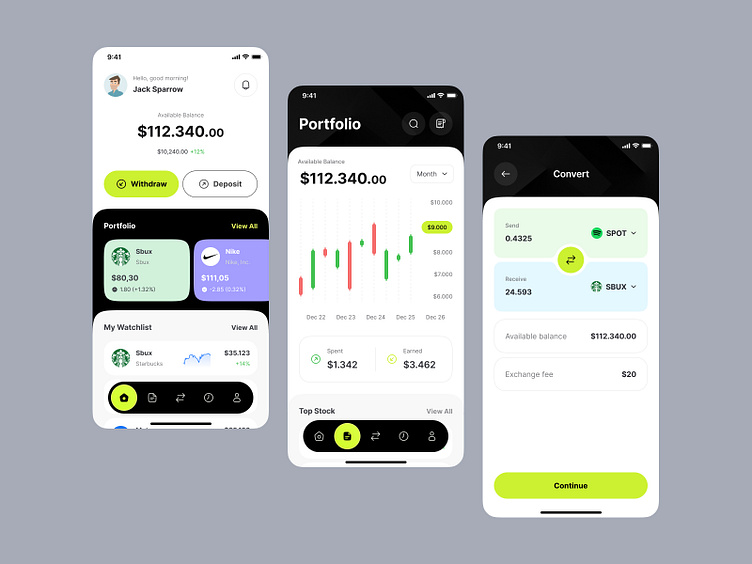

Payment & Stock Market app UI UX Mobile Design

Hello Enthusiasts📈🌐

I'm thrilled to share my latest project: a UI/UX design for a stock market app that transforms how users engage with financial markets. This app is designed to make trading accessible and straightforward, offering real-time data, advanced charting tools, and personalized watchlists to keep users at the forefront of market trends.

Hope you find it as intriguing as I do!

Dreaming up something amazing? Let's chat! Drop me a line at R.koohi99@gmail.com or connect with me on LinkedIn.

Let's make magic happen together! 🌈

Thinking of bringing your own vision to life?

I’m all ears! Reach out at R.koohi99@gmail.com or let's connect on LinkedIn for a brainstorming session. Together, we can craft something extraordinary! ✨

💬 Let's discuss!

I'm online in Telegram and discord to discuss about your project:

Telegram: http://t.me/doctordesign

Linkedin: https://www.linkedin.com/in/roohollah-koohi-a998a7b9/

A Payment & Stock Market App combines the features of a digital wallet or payment app with the tools of a stock market trading platform. This hybrid app caters to users who want to manage their finances, make payments, and invest in stocks or other financial instruments from a single platform. Below is a comprehensive guide to building a Payment & Stock Market App, including essential features, technology stack, and monetization strategies.

Key Features of a Payment & Stock Market App:

1. User Registration and Profiles

Sign-Up/Login:

Allow users to register via email, phone numbers, or social accounts.

Implement KYC (Know Your Customer) verification for compliance and security.

User Profiles:

Store personal details, linked bank accounts, credit cards, and investment preferences.

Account Types:

Offer basic accounts for payments and premium accounts for trading with advanced features.

2. Payment Features

Digital Wallet

Fund Management:

Let users add funds to their wallet using credit/debit cards, UPI, net banking, or mobile wallets.

Peer-to-Peer Transfers:

Enable users to send and receive money instantly with contacts.

Split Payments:

Allow users to split bills with friends or family.

Bill Payments

Utility Payments:

Provide options for paying electricity, water, gas, and internet bills.

Recharge and Subscriptions:

Support mobile recharges and subscription renewals for services like streaming platforms.

QR Code Payments

Merchant Payments:

Allow users to scan QR codes to pay at local stores or online merchants.

Saved Merchants:

Let users save frequently used merchants for quick payments.

Multi-Currency Support

Cross-Border Payments:

Allow users to send or receive money in multiple currencies with real-time exchange rates.

3. Stock Market Features

Market Data and Insights

Real-Time Stock Prices:

Provide live updates on stock prices, indices, and commodities.

Market News and Trends:

Integrate news feeds and trend analysis from financial sources.

Stock Watchlists:

Enable users to track specific stocks or sectors with personalized watchlists.

Trading Tools

Buy/Sell Orders:

Support instant, limit, stop-loss, and take-profit orders.

Fractional Shares:

Allow users to invest in fractional shares of high-priced stocks.

Leverage and Margin Trading:

Offer advanced trading options with clear risk warnings.

Pre-Market and After-Hours Trading:

Extend trading hours for select stocks based on user demand.

Portfolio Management

Overview and Insights:

Display a detailed view of user investments, returns, and allocations.

Performance Metrics:

Provide daily, weekly, and monthly profit/loss reports.

Dividend Tracking:

Show upcoming and historical dividend payouts for stocks.

Educational Tools

Beginner Guides:

Offer tutorials on stock market basics, trading strategies, and app usage.

Simulated Trading:

Include a demo account for users to practice trading with virtual money.

4. Analytics and Insights

Spending Insights:

Provide visual breakdowns of user spending habits by category (e.g., food, shopping, travel).

Investment Insights:

Display trends, top-performing stocks, and areas for portfolio improvement.

Net Worth Tracking:

Combine payment wallet balances and investment portfolio to display overall financial health.

5. Notifications and Alerts

Payment Alerts:

Notify users about successful transactions, bill due dates, and refunds.

Market Alerts:

Send updates on price changes, stock trends, and breaking financial news.

Custom Alerts:

Allow users to set price alerts, target prices, or budget reminders.

6. Security Features

Two-Factor Authentication (2FA):

Add an extra layer of security for account logins and transactions.

Biometric Authentication:

Support fingerprint and facial recognition for quick and secure access.

Encryption:

Use end-to-end AES-256 encryption for sensitive data and transactions.

Fraud Detection:

Monitor suspicious activities like abnormal transaction patterns or unauthorized trades.

7. Admin Dashboard Features

User Management:

Monitor user activity, verify KYC documents, and manage disputes.

Transaction Monitoring:

Track payments, stock trades, and revenue generation in real time.

Revenue Analytics:

View detailed reports on commissions, transaction fees, and subscription earnings.

Market Data Management:

Manage and update stock listings, indices, and real-time feeds.

Advanced Features for a Payment & Stock Market App:

AI-Powered Recommendations:

Suggest stocks, ETFs, or financial goals based on user behavior and market conditions.

Multi-Language and Currency Support:

Enable global accessibility with support for multiple languages and currencies.

Voice Commands:

Allow users to perform actions like transferring funds or placing trades via voice.

Dark Mode:

Offer light and dark themes for user comfort.

Gamification:

Introduce rewards, badges, or milestones for savings, investments, or payments.

Technology Stack for a Payment & Stock Market App:

Frontend Development:

Mobile: React Native, Flutter (cross-platform), or native platforms (Swift for iOS, Kotlin for Android).

Web: React.js, Angular, or Vue.js for a responsive interface.

Backend Development:

Languages: Node.js, Python (Django/Flask), Ruby on Rails.

Database: PostgreSQL, MySQL, MongoDB.

Real-Time Communication: WebSockets, Firebase.

APIs and Integrations:

Payment Gateways: Stripe, PayPal, Razorpay, Square.

Stock Market Data: Alpha Vantage, Polygon.io, Yahoo Finance, Binance (for crypto).

Currency Exchange: XE.com API, Open Exchange Rates.

SMS and OTP Verification: Twilio, Nexmo.

Email Services: SendGrid, Amazon SES.

Infrastructure:

Hosting: AWS, Google Cloud, Microsoft Azure.

Encryption: OpenSSL, libsodium.

Push Notifications: Firebase Cloud Messaging, OneSignal.

Monetization Strategies:

Transaction Fees:

Charge users a small fee for every payment or trade executed.

Subscription Plans:

Offer premium features like advanced analytics, priority customer support, or lower trading fees under a subscription model.

Spread Earnings:

Earn from the spread (difference between buy and sell prices) on trades.

In-App Purchases:

Sell advanced tools like AI-driven insights, financial planning templates, or exclusive market data.

Affiliate Marketing:

Partner with credit card companies, brokers, or financial advisors to earn commissions.

Sponsored Listings:

Allow companies or stocks to feature themselves in search results or recommendations.

Best Practices for a Payment & Stock Market App:

User-Centric Design:

Create an intuitive interface with clear navigation for both payments and trading.

Ensure Scalability:

Build a backend capable of handling increasing users, transactions, and real-time data updates.

Focus on Security:

Regularly audit the app and encrypt all sensitive information.

Compliance:

Adhere to local financial regulations (e.g., PCI DSS, GDPR, SEC guidelines).

Customer Support:

Provide 24/7 support via live chat, email, or call for payment and trading issues.

Example Use Case Scenarios:

Beginner Investors:

Combine budgeting tools with beginner-friendly investment options like ETFs or mutual funds.

Frequent Traders:

Provide advanced analytics, real-time alerts, and quick order execution.

Global Users:

Enable cross-border payments and investments with multi-currency support.

Small Businesses:

Offer tools for managing payments, tracking expenses, and short-term investments.

Conclusion:

A Payment & Stock Market App merges the functionality of a digital wallet with a stock trading platform, offering users a centralized solution for managing their finances and investments. By integrating essential features like secure payments, real-time market data, and portfolio tracking, you can create an app that appeals to a wide range of users. Focus on user-friendly design, robust security, and scalable infrastructure to ensure success in the competitive fintech space.

.

💬 Let’s discuss!

I’m online in Telegram and Discord to discuss your project:

Telegram: http://t.me/doctordesign

Discord: https://discordapp.com/users/r.koohi99#8459

LinkedIn: www.linkedin.com/in/rooholla

Email: Hi@roohi.pro