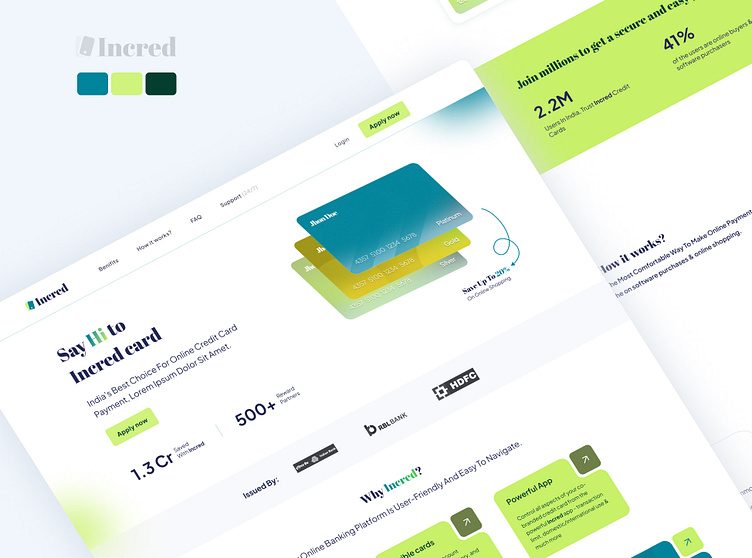

Incred website design

Persona

Persona Name: Neha Mehta Age: 29 Occupation: Marketing Manager at a Tech Startup Location: Mumbai, India Income Level: ₹12-15 lakhs per annum Marital Status: Single

Background

Neha is a tech-savvy young professional working in a fast-paced environment. She is financially independent and enjoys a modern, urban lifestyle.

She manages her finances carefully, paying attention to rewards, cashbacks, and deals on her credit cards.

Neha loves using technology to simplify her life and prefers services that offer transparency and control over her financial decisions.

Goals

- Wants a credit card with modern features, rewards for frequent use, and an easy-to-manage app interface.

- She seeks a seamless experience that integrates well with her digital lifestyle, from tracking expenses to making payments in real-time.

- She is interested in building her credit score for future financial goals like taking a home loan.

Pain Points

- Frustrated with traditional credit card providers that have outdated processes, hidden fees, and unclear terms.

- Finds it cumbersome to track spending and rewards across multiple cards.

- Dislikes dealing with long customer service wait times or dealing with issues through traditional call centers.

Goals

Maximizing Online Shopping Savings: Seeking a credit score card with significant rewards for on-line purchases.

Expense Tracking: Values a credit card with built-in expense monitoring and budgeting equipment.

Virtual or Physical Cards: Prefers the flexibility of both digital and physical cards.Spend Analytics: Interested in precise spend analytics for higher financial insights.

User says: "I need a credit score card that aligns with my tech-savvy life-style—maximizing savings on online shopping and presenting tools for efficient financial control"

Thumbnail below