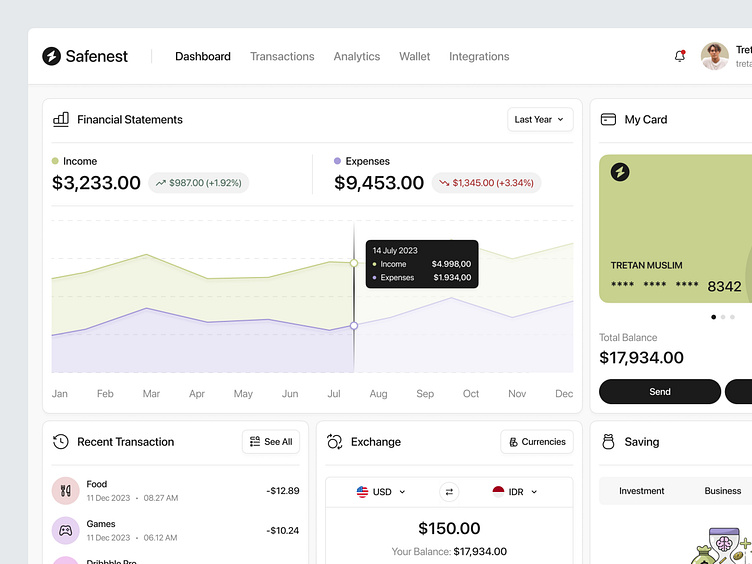

Safenest - Finance Dashboard

Overview:

Safenest was launched in response to the growing need for inclusive financial services. Aiming to bridge the gap between traditional banking and the unbanked population, the app set out to provide a user-friendly platform for various financial transactions, including banking, investments, and payments.

Challenges:

Data Fragmentation: Users struggled with managing financial data spread across multiple accounts, institutions, and platforms.

Limited Financial Visibility: Lack of real-time insights hindered users' ability to make informed financial decisions promptly.

Security Concerns: Users were cautious about the security of sensitive financial information when consolidating data from diverse sources.

Solution:

Safenest tackled these challenges head-on with the following key features:

Unified Dashboard: A centralized dashboard integrated with various financial accounts, providing users with a holistic view of their financial health in real-time.

Advanced Analytics: Robust analytical tools and customizable reports empowered users to gain deep insights into their spending patterns, investments, and overall financial performance.

Automated Transactions: The dashboard allowed users to automate recurring transactions, bill payments, and investments, streamlining financial management processes.

Automated Saving Plans: Users could set up automated savings plans based on their financial goals and preferences, ensuring consistency in their saving habits.

Real-Time Exchange Rate Updates: The dashboard provided users with up-to-the-minute exchange rates, ensuring transparency and empowering users to make timely currency conversion decisions.

Results:

Safenest witnessed rapid adoption, with millions of users joining within the first year of its launch. The app successfully brought banking services to previously underserved populations, fostering financial inclusion on a significant scale.