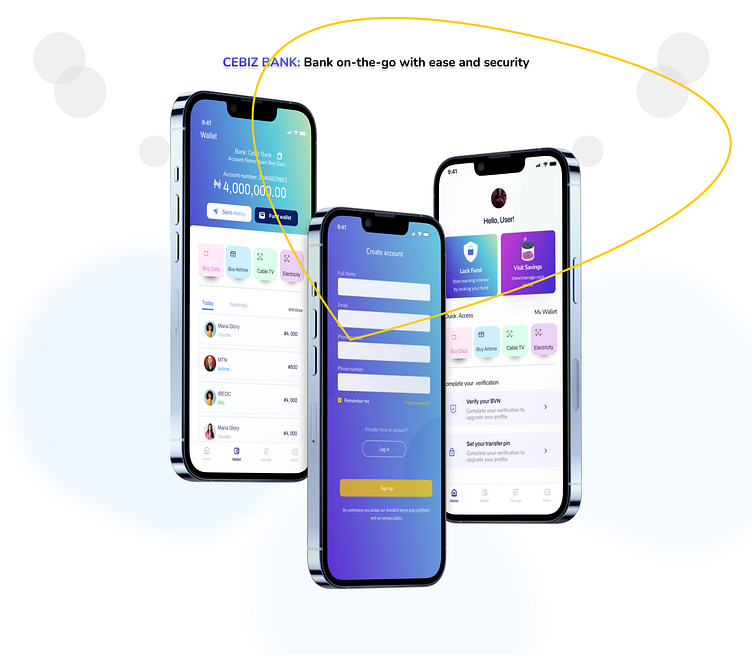

CEBIZ FINANCE APP

Project Overview:

Our company, CEPHAS DIGITAL HUB wanted to create a mobile e-banking app to offer customers a more convenient and accessible way to manage their finances. The app would need to provide a range of features, including account management, transaction history, bill payments, and money transfers. We wanted to create a user-friendly and visually appealing e-banking app that would provide a seamless and secure user experience.

Challenge:

The main challenge was to design an app that would be easy to use and navigate, while still providing all the functionality that users needed to manage their finances. We also needed to ensure that the app was secure and protected user data from potential cyber threats.

Research and Discovery:

As the UI/UX designer, I started the project by conducting research to understand the needs and preferences of e-banking users. I conducted surveys and user interviews to understand the pain points and challenges faced by users, as well as their preferences for user interface design and features. I also conducted competitive analysis to understand the best practices and trends in e-banking app design.

Strategy:

Based on my research findings, I developed a strategy that focused on providing a user-friendly and visually appealing interface, while also ensuring the security and privacy of user data. I decided to prioritize the following features:

User authentication

Clear and intuitive navigation to enable users to quickly access the features they need

Consistent use of visual design and language to create a seamless user experience

Real-time transaction updates and push notifications to keep users informed of their account activity

Simplified money transfer and bill payment features to make financial management more convenient for users

Design Process:

After analyzing our research, we developed a design strategy that focused on creating a clean, intuitive, and user-friendly interface. We also incorporated several key features that we identified during our research, including:

Account summaries: Users could quickly view account balances and recent transactions.

Transfers: Users could easily transfer funds between accounts, make payments, and set up recurring transactions.

Alerts: Users could receive real-time alerts for account activity, balance changes, and other important events.

Security: We incorporated several security features, including two-factor authentication, biometric login, and secure data encryption.

We also tested our designs with users to ensure that the app was easy to navigate and that all of the features were easily accessible.

Development:

Once the design was finalized, I worked closely with the development team to ensure that the app was developed to our specifications. We conducted regular testing to identify and fix any bugs or issues, and provided feedback and guidance to the development team as needed.

Launch and Results:

The e-banking app was launched on Android platforms. It was well-received by users, with many praising its user-friendly interface and convenient features. The was an increase in customer engagement and satisfaction, as well as a decrease in customer service inquiries related to account management. The e-banking app has since become a key tool for the financial institution, helping them to better serve their customers and remain competitive in the e-banking industry.

Improvement:

After launching the app, and seeing it was well accepted. Now, we are looking into creating web application of CEBIZ having the same features as the mobile app, so everyone - equity, can easily access the app.

Conclusion:

Through user research and a focus on creating an intuitive and user-friendly interface, we were able to design an e-banking app that met our users needs and exceeded user expectations. By incorporating security features and testing our designs with users, we were able to create an app that was both easy to use and secure, providing a seamless banking experience for our customers.