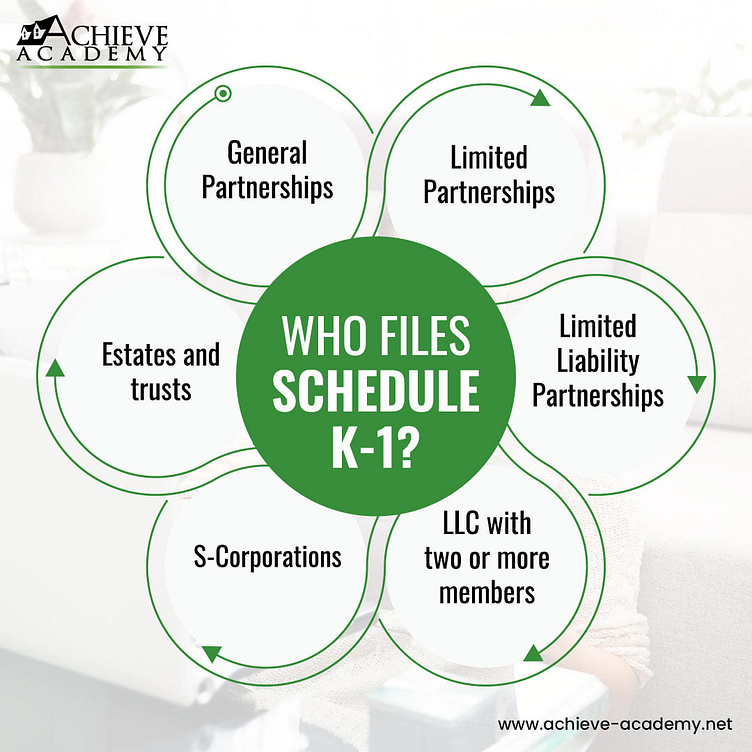

Who Files Schedule K1?

If you fail to file your federal income tax return as a result of failure to receive schedule K-1, you incur additional penalties..

Failure to file penalties is 5 percent, and the IRS charges an additional 0.5 to 1 percent for failure to pay any taxes owed..

Want to learn more about Schedule K-1? Here's a FREE RESOURCE:

https://achieveinvestmentgroup.com/understanding-your-schedule-k-1-and-real-estate-taxes/

More by Achieve Investment Group View profile

Like