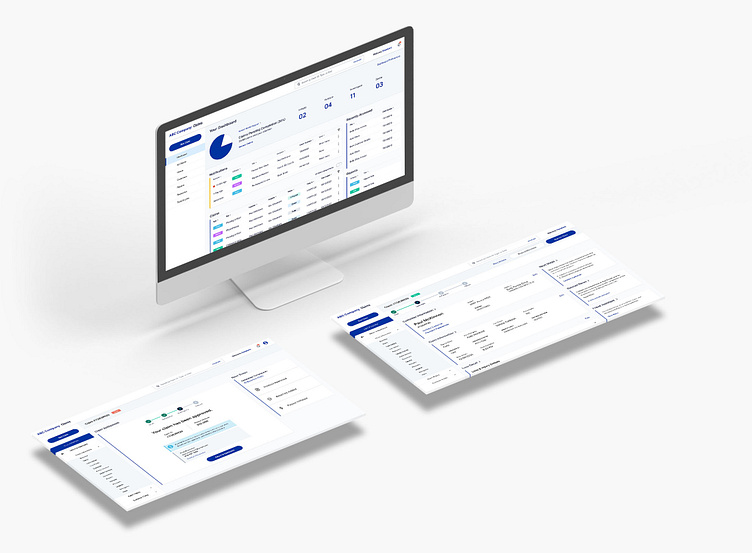

Insurance Mobile App for customer and Desktop App for Adjuster

The claims process is a clear priority for CX innovation, and insurers are looking to digitize it as much as possible and put control in policyholders’ hands. Insurers will need to make continued investments in delivering a better digital policyholder experience — particularly in claims — supported by a new workforce model powered by automation and AI.

As an insurance company, the insurance company's job is to be available at exactly the right time, however their customers need them – regardless of the context of the incident, the location the customer is in, or the devices to which they have immediate access. Building trust and loyalty with customers requires that customers feel their Adjuster is the expert they can lean on—someone who will use their knowledge to get things done in the customers interest, and make the process easier to manage and follow along the way.

As customers navigate their claims journey, they want easy, quick access to Adjusters. They need visibility at every stage, to feel like their claims are actively being worked on. The desire for “access to information” manifests differently for customers, so being mindful of alternative ways to share and push information to customers should be strongly considered in the ideal state design.

Key investments aim to shift low-complexity interactions to self-service, giving policyholders greater control and enabling them to navigate through their preferred channels in each level of the process. The challenge is to provide a smooth transition between each channel.