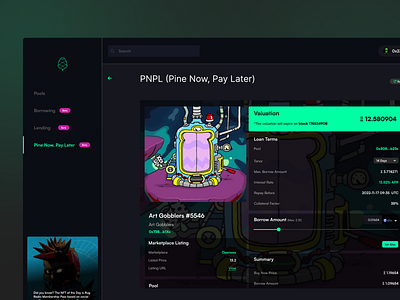

PNPL (Pine Now, Pay Later)

NFT buyers can get a mortgage for the NFT purchase on open marketplaces in one atomic transaction. The transaction will be settled with funds from the buyer’s wallet and loan from the protocol in a ratio that the buyer deem appropriate and can satisfy the loan’s LTV requirements. The newly acquired NFT will be owned by the protocol as a collateral for the loan that the buyer initiated during the transaction in the same way as an ordinary NFT loan.

PNPL (Pine Now, Pay Later) can effectively facilitate NFT margin trading with only a fraction of the initial cost in acquiring an NFT, providing leverage to traders in a simple atomic transaction. With a term loan instead of continuous loan structure, traders face less pressure from the price volatility and a longer runway before a margin call is triggered.