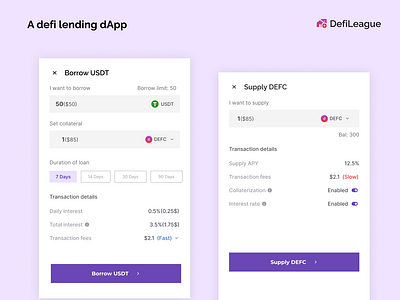

A DeFi Landing dApp

Decentralized lending dApps let users lend cryptocurrency to others to gain annual yields. Decentralized borrowing allows individuals to borrow money at a specific interest rate. Unlike traditional finance, these DeFi protocols enable peer-to-peer lending, removing the need for intermediaries.

Because DeFi lending protocols use an automated smart contract to enable loans, users don’t wait to get their funds.

To borrow tokens you will set a collateral, and pay a daily interest that will accumulate over your loan period

Decentralized lending dApps let users lend cryptocurrency to others to gain annual yields. Decentralized borrowing allows individuals to borrow money at a specific interest rate. Unlike traditional finance, these DeFi protocols enable peer-to-peer lending, removing the need for intermediaries.

If you lend your tokens by locking your tokens in — just like with a traditional bank — receive an interest, mostly shown as APY or Annual Percentage Yield.