Defi Vault

In the DeFi space, there are many projects that issue rewards to users for interacting with their platforms, one example is “staking” tokens on a platform which in turn can increase the total locked value for that project.

Typically LP (Liquidity Pool) tokens are used for this purpose as many projects issue rewards in return for users providing the liquidity needed to make the platform run. This is commonly referred to as “yield farming”.Yield farming for an individual with limited funds can be cost prohibitive due to high transaction costs for claiming rewards.

To solve this problem, “yield aggregators” are sets of contracts that pool these staked funds together and allow users to optimize their yield farming by allowing “vaults” to automatically harvest their farming rewards and reinvest them in the liquidity pools, resulting in compounded gains.

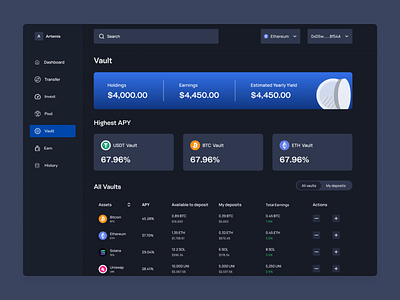

These vaults allow depositors to not have to worry about gas fees which maximize the returns they can earn on various yield farms.I designed a vault interface to help users optimize their yield farming returns.