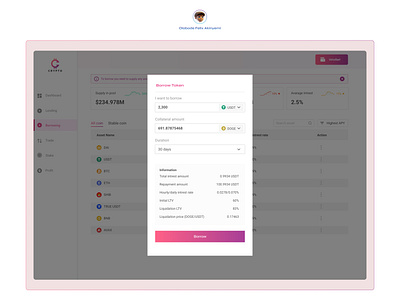

Borrowing in DeFi (Web3)

Lending and Borrowing in web3

DeFi lending allows users to lend and borrow concurrently. It runs on a smart contract (open blockchain) accessible to all without credentials.

The protocols used in lending and borrowing are AAVE and Compound.

Lenders (depositors) provide funds for borrowers to pay back with interest.

Borrowers are loan takers willing to pay interest on the amount they borrowed.

Lenders supply their tokens to a particular money market (AAVE or Compound) and then are sent to a smart contract that is made available to borrowers. The smart contract provides tokens that represent the suppliers’ tokens with interest.

Those tokens provided are called:

A-token in AAVE and C-token for Compound.

These tokens are redeemable on their respective smart contracts.

Borrowers provide tokens in form of collateral that is worth more than the loan a borrower needs.

Question: Why should you borrow when you have tokens worth more than what you need?

You have tokens you don't want to sell/change, but you need money/finance for other things

Borrow funds to increase your leverage.

Borrowers can get their collateral back when they pay back their loans, otherwise, it can be liquidated if your collateral falls below the market value (because the crypto market is volatile changes can occur anytime).