Moneysave- savings app

About the project

Competitor Analysis

Insights from Competitor Analysis

Apps focus more on budgeting as a primary feature, with features like track in as an add-on to budgeting. Some go as far as incorporating a credit check as on of the add-ons.

Delivering insights is a must have in all 3. I think it is a tool that helps keep people motivated. I love the idea of nudges- I imagine receiving a "nudge" while spending on a card I have added onto the app. The downside, particularly for the apps that allow users to add multiple cards is that it can end up feeling invasive to constantly receive nudges each time you spend. While the intention is to encourage people to keep their spending in check, it could easily end up causing some people to switch off their push notifications and therefore lose track of where they are on their journey (after a while).

A lot of users responded well to personalizing their spend categories- i.e. being able to add a new name/ color / icon. I think it is a fun element to add on.

Another thing I have picked up is that people want to be able to track their spending over a period of time and not just in one month. ( e.g. 6months)- some went as far as suggesting that they would love to be able to print out their feedback

People want to be able to set savings goals (one of the apps did not have the feature to add a goal and about 2 people commented on that). Security and privacy or protection of data is very critical- people should not feel like their information is up for sale to big corps.

The reason why people end up not having savings or a plan thereof- is not only due to being financially illiterate, it also points to not budgeting. (overspending and not having much left to save).

Many of these apps tend to have a lot of features and with good reasoning- however the core functionality tends to get lost in all the noise.

Survey Responses

User persona

Based on research findings & insights from survey

User journey mapping

Rough paper scamps

1. Goal & Due date

2. Progress

3. Title

4. Filter

5. Activity

6. Scroll to select your income amount

7. Scroll to select your spend amount

8. Add a goal

9. Save

10. Name of Goal

11. Goal description

12. Checklist

13. Target date

14. Notification on / off

Mid fidelity wireframes

Annotations

1. List of goals

2. Button to create a new goal

3. Accountability checklist - add a list of actions that can help you work towards your goal

4. Add a collaborator (Optional)

The purpose behind asking users to submit their income bracket and a rough estimate of how much they spend monthly, is so that insights can be generated to inform users whether their goals are realistic or not. Oftentimes, users add unrealistic goals to apps and end up getting demotivated - this is to prevent that from happening, and to ensure that whoever uses the app is intentional about their financial future.

Users will be able to link their savings accounts into the app. This is to ensure that the app is integrated into the user’s lives, and to keep a sense of accountability.

Style Guide

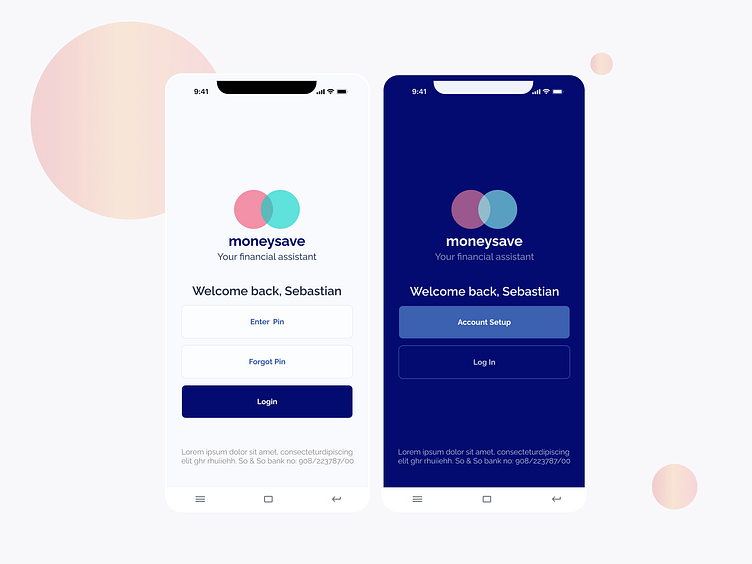

UI screens

UI screens