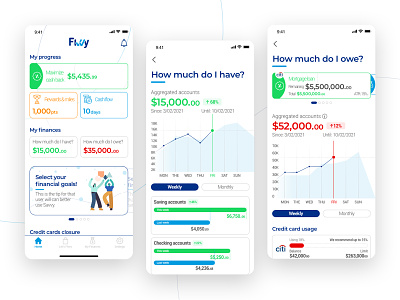

FIVVY - Your Pocket CFO

A personal CFO in your pocket. Fivvy is a financial helper that looks at your finances and help you become stable. Start by choosing a goal and the app helps reach the goal, From wanting more cash, learning how to save more efficiently, or manage the payment of bills.

ABOUT

Looking to build financial literacy, a money counter, a bill organizer, an expense tracker or even for financial advice and direction? Welcome to Fivvy, your pocket-CFO. Fivvy is the go-to mobile app for money management and the solution to efficient budget and expense tracking.

Why settle for a simple money counter when you can also have a money saver? Fivvy does both and empowers users with the awareness they need to balance their cash accounts and savings accounts. New users can sign up in just a few clicks and begin saving money, reigning in debt, and building money control. Fivvy gives you access to detailed data about the life of credit cards and other loans and credit products. Collectively, these resources can empower you better to evaluate your past, present, and future purchases.

SECURITY

Your peace of mind is among our chief concerns. As an expense manager, Fivvy prides itself on being user-friendly, safe, secure, and efficient. With biometric data login, two-factor authentication, and verification codes, you can rest assured that your data is safe.

Because the Fivvy platform is integrated with Plaid, high security does not inhibit your access to vital data that can help you with your financial planning. You can access all your financial information in one place. This allows you to manage transactions-- past, present and future – while keeping your goals in clear view.

FUTURE FINANCIAL PLANNING

By selecting three out of six goals, you can set your financial priorities and even assign them relative values. By doing so, you also shape how Fivvy’s decision engine interacts and recommends different payment methods best suited for your financial objectives. Effectively, everything is personalized to your needs. Based on your financial goals, Fivvy helps you manage transactions at the time of purchase and gets you more cash back.

Likewise, an easy purchase input method lets you log their expenses to keep track of your spending history. With Fivvy, you can also spot cash back opportunities that might have otherwise gone overlooked or keep tabs on loan help opportunities. Depending upon your user preferences, Fivvy recommends new credit products that can help you save time and energy.

Thus, the Fivvy mobile app is a user-friendly expense manager that doubles as a money saver. In other words, the more aware you are of your spending habits, the more control you have over how to make your money work for you rather than the other way around.

FEATURES

Create a user profile in a few clicks.

Secure your login with biometric authentication and 2-Factor verification

Connect Fivvy to your bank accounts and cards

Set 3-6 clear financial goals, and prioritize them according to your needs

Log purchases, track expenses and view your spending history

Select your preferred paying method for one-time or recurring expenses

Fivvy recommends to you the best payment method for saving money on the spot

Manage your cash inflow and outflow through “My Finances”

Monitor your assets through income history, account totals, and other metadata

Evaluate your liabilities through spending history, debt by credit card

Set bill reminders for upcoming recurring expenses

Learn about new credit products that can help your financial journey

From start to finish, Fivvy is equipped to be your go-to personal financial planner. Who wouldn’t want to keep track of your checking account’s inflow and outflow in the same place where you can easily find your bill reminders and receipt trackers? Download the app today and join countless others in managing your finances with complete peace of mind.

Let’s Fivvy!