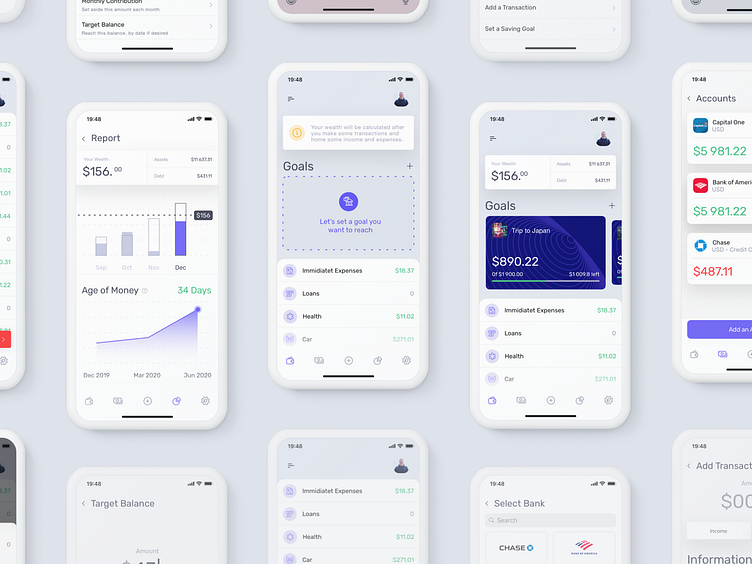

Akuna - Personal Finance

Contactless cards and online shopping sites make payment a breeze.

But studies show that the use of contactless can increase spending 8 to 10% by making it harder to monitor our spending.

A debt-driven society

Too many millennials who carry credit-card debt don’t know how expensive it is.

A survey ran by Northwestern Mutual comprised 503 Gen Zers, 672 millennials, 595 Gen Xers, and 441 baby boomers. On average, millennials who carry debt report owing to a total of $27,900 (excluding mortgages), slightly less than baby boomers and about $8,000 less than the average amount Gen Xers owe.

34% of Americans don’t know how much of their monthly income goes toward paying down their personal debt.

Debt is a struggle even for wealthy millennials. It’s time to change this

You can read the full case study HERE

📸Follow me on Instagram for some behind the scenes.

📩Available for freelance projects: hi@jeliazkovdesign.com